When Artificial Intelligence Meets Power Grids and the Future of Digital Money

In 2026 a major turning point is unfolding in the world of technology and energy. What started as an optimistic narrative linking artificial intelligence and cryptocurrencies is now becoming an intense competition for a resource that is fundamental to both industries but finite in supply. According to the latest outlook from one of the largest asset management institutions in the world, energy itself is the new battleground where investment fortunes will be won and lost and where the future of Bitcoin mining and artificial intelligence will collide.

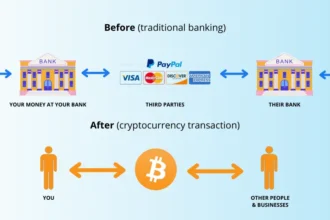

For many years Bitcoin mining and artificial intelligence operated in largely separate spheres. Bitcoin mining used a specialized process that requires powerful computers solving mathematical puzzles to secure a digital currency network and create new coins. This process consumed electricity and was a frequent topic of debate about energy waste and environmental impact. Artificial intelligence on the other hand was often viewed primarily as software running in data centers that could boost productivity or enable new tools and services. But the new energy picture is changing that story in profound ways.

BlackRock’s global outlook suggests that artificial intelligence is no longer just a software story it has become an energy story. The construction of large scale data centers that run advanced AI models around the clock is demanding more electricity than many analysts expected. In fact artificial intelligence based infrastructure could soon represent a major portion of total energy consumption on national grids as data centers expand and new facilities are built. This means that energy is no longer simply a cost input to technology it is now a strategic asset that both industries must compete for.

For Bitcoin miners the implications are serious. Historically Bitcoin mining argued that it can be a flexible partner for electricity grids able to absorb excess generation when demand is low and reduce output when demand peaks. This model allowed many miners to operate in regions with surplus or low cost power. But as artificial intelligence systems demand stable uninterrupted energy to maintain their processing and training needs the pressure on power grids is shifting. Data centers hosting AI systems cannot afford sudden outages or curtailment in the same way that flexible Bitcoin miners can. This changes the politics of grid access and could make AI infrastructure a preferred customer of utilities and regulators.

Energy scarcity in grid systems creates a scenario where both mining and data centers compete for the same electricity. In some regions this may lead to higher costs for both industries as utilities upgrade infrastructure or alter pricing models to manage rising demand. Electricity that was once affordable and abundant in certain areas could become contested with implications for regional economic development and investment decisions. The outcome could reshape where and how both Bitcoin mining and artificial intelligence facilities are located.

The rise of artificial intelligence as a structural source of energy demand is also likely to influence public perception and regulatory scrutiny. Bitcoin mining has faced criticism in the past for its energy use and carbon footprint. With artificial intelligence now consuming equivalent or greater amounts of electricity the debate over sustainability is no longer focused on one technology alone. It raises the larger question of how modern societies power computational infrastructure and whether current energy systems can support the rapid expansion of digital technologies without harming environmental goals.

One vision for addressing these challenges focuses on building cleaner and more resilient power systems. If artificial intelligence and Bitcoin mining are to coexist without exacerbating climate problems then investment in renewable energy sources such as solar wind and nuclear power will have to accelerate. Governments and private investors are already discussing massive upgrades to power grids energy storage systems and transmission networks to handle rising demand from a wide array of technologies. But the scale of investment required is enormous and decisions made today will influence whether energy supply can keep pace with demand without significant increases in emissions.

Beyond the environmental aspect there is also a strategic dimension. Nations that can build reliable low carbon power systems may have a competitive advantage in both artificial intelligence and blockchain technologies. Energy security has always been a component of national economic strength but it is becoming even more central as technological infrastructure becomes more energy intensive. Policies that encourage clean energy investment grid modernization and power sharing mechanisms may be necessary to avoid bottlenecks that choke growth in key industries.

Bitcoin miners do not necessarily have no role in this new energy landscape. Some miners are exploring how to integrate renewable energy sources into their operations. Others are seeking locations with abundant low cost power including geothermal or hydroelectric generation. There are also efforts to make mining hardware more efficient to reduce electricity demand per unit of work. But in an environment where artificial intelligence data centers demand stable energy around the clock the flexibility argument may lose some of its weight in decision making about grid usage and infrastructure planning.

At the same time artificial intelligence systems are not free from environmental and energy concerns. Large language models real time analytics and advanced computation require constant power to stay online and training complex models can consume vast amounts of energy. Critics argue that if these systems rely primarily on fossil fuel based grids they could undermine efforts to reduce overall carbon emissions. Supporters point out that artificial intelligence can itself help optimize energy systems make grids more efficient and reduce consumption in other sectors. The real outcome will depend on how quickly clean energy infrastructure grows relative to digital demand and whether technological efficiency gains can offset expanding use.

Another emerging trend is the repurposing of traditional data processing facilities including Bitcoin mining centers into AI computing hubs. Some companies with large energy capacity are considering converting or sharing their infrastructure to support artificial intelligence workloads. This reflects a larger shift in how computational power is valued. As AI grows further into every corner of business and society the demand for specialized servers graphic processing units and parallel processing power may rival or even surpass demand from digital currency mining.

The competition over energy resources is not just technical it is economic. Electricity pricing models energy contracts and priority grid access all play roles in how infrastructure projects are financed and where they are located. Utilities may face pressure to balance the needs of industrial users educational institutions residential customers and energy hungry technology applications. The way they manage these competing interests will shape community outcomes including job creation for new facilities and environmental impact for local areas.

In this context energy becomes a form of currency itself. Technologies that can operate effectively within constrained energy systems or help reduce costs will be more attractive to investors. Clean power projects for example may become not only environmental choices but strategic investments that underpin growth in artificial intelligence and blockchain technologies. Energy storage solutions such as large scale batteries pumped storage and new grid management tools will also become critical pieces of the puzzle.

The long term implications of this energy shift are difficult to predict with precision but the conversation has clearly moved beyond whether artificial intelligence or Bitcoin mining are good or bad in isolation. The real question now is how energy systems can adapt to a world where multiple powerful technologies compete for limited resources. Governments business leaders and communities will all play roles in deciding which technologies are supported and how growth is balanced with sustainability and equity.

The outcome of this battle for power grids in 2026 and beyond will not only determine the fate of Bitcoin mining and artificial intelligence facilities. It will also influence how societies think about infrastructure investment economic planning and environmental stewardship in a world where digital and physical systems are deeply intertwined.