Why NFT Activity Is Rebounding and What It Means for Crypto’s Creative Economy

In late 2025, the non-fungible token (NFT) market showed a notable resurgence, with total sales increasing by 12 percent to $67.7 million over the most recent reporting period. The headline numbers point to growing engagement across digital collectibles, but a deeper look reveals that activity on Ethereum the largest smart contract ecosystem was especially strong, with sales surging by approximately 45 percent.

This rebound comes after several months of muted activity across parts of the NFT space earlier in the year, where market participants grappled with tighter sentiment and a broader crypto pullback. The renewed interest reflects a combination of factors, including increased collector demand, ecosystem-wide developments that improved user experience, and broader macro signals suggesting renewed capital flow into digital assets. As the largest chain for NFT issuance and trading, Ethereum’s improved performance played an outsized role in the overall sales increase.

NFTs unique digital assets typically representing art, music, collectibles, or game items have always stood at the intersection of culture and technology. Their market value tends to be driven as much by cultural trends and storytelling as by pure financial demand. As sales volumes increased across marketplaces, observers noted a diversification in the types of NFTs trading hands, with both generative art collections and utility-driven asset classes (such as gaming and membership tokens) contributing to the uptick. This broadening of demand suggests that buyers are not simply chasing speculative gains, but are increasingly engaging with NFTs for their embedded utility, social identity, or platform access.

The sharp rise in Ethereum-based NFT sales up roughly 45 percent is particularly meaningful. Ethereum has long been the go-to network for NFTs due to its established ecosystem, liquidity, and developer infrastructure. Recent upgrades and ecosystem enhancements, including improvements to scalability and lower effective transaction costs via Layer-2 solutions, have made minting and trading NFTs more efficient and affordable. This has lowered barriers to entry for creators and collectors alike, fueling the surge in activity.

Market data indicates that this resurgence has been powered by both retail collectors and institutional participants dipping their toes into NFT markets. For retail users, social and cultural drivers including community engagement, celebrity collaborations, and themed drops have reinvigorated interest. For institutional actors, evolving regulatory clarity and clearer custodial pathways for digital assets have made it easier to consider NFTs as part of diversified portfolios or innovative engagement strategies.

One of the trends observers highlighted was the continued growth in secondary market activity that is, the buying and selling of NFTs already in circulation. This metric is often considered a stronger indicator of a healthy collectible market than primary sales alone, which can be driven by initial hype. A healthy secondary market suggests that holders are willing to trade and transfer NFTs after initial minting, which in turn signals deeper liquidity and sustained interest. The reported sales increase therefore reflects not just new issuance, but meaningful participation across the lifecycle of NFT assets.

Part of the narrative driving renewed interest is that NFTs are increasingly being constructed with utility layers that extend beyond simple collectibility. For example, some projects embed access rights, governance privileges, or play-to-earn components that interact with broader decentralized finance (DeFi) or gaming ecosystems. These hybrid use cases blur the line between static collectibles and dynamic digital assets, offering holders a blend of cultural and economic incentives. The broader appeal naturally attracts a wider set of buyers, which helps lift aggregate sales figures.

Another factor boosting activity is the expansion of curated marketplaces and discovery platforms that help match collectors with assets they find meaningful or valuable. By improving searchability, categorization, and user experience, these platforms are reducing friction for new participants entering the NFT space. As a result, engagement is no longer limited to those deeply embedded in crypto culture casual users and newcomers are finding it easier to browse, discover, and transact in NFTs.

Despite the positive momentum, analysts caution that the NFT market remains volatile and early stage relative to traditional art or gaming markets. While sales increases are encouraging, the overall NFT ecosystem still represents a relatively small subset of total crypto market capitalization. Moreover, microtrends within the NFT sector such as the popularity of a specific collection or the impact of celebrity endorsements can create lumpy and short-lived bursts of activity that may not always translate to sustained growth.

Still, the current uptick is notable for several reasons. First, it reflects a broader shift from purely speculative narratives toward ecosystem-driven engagement. In prior cycles, surges in NFT sales often correlated with rapid price expansions across crypto markets as a whole. In contrast, the latest surge appears more organic and use-case driven, with communities coalescing around shared digital experiences rather than simply chasing price gains.

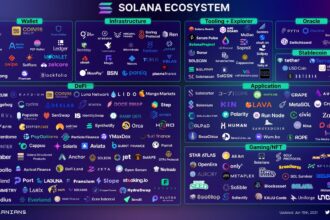

Second, the role of Ethereum as the dominant NFT chain underscores the value of network effects. While competitors and alternative Layer-1 blockchains have tried to carve out their own NFT niches, Ethereum’s liquidity, tooling, and developer base continue to draw both creators and collectors. The recent spike in Ethereum NFT sales suggests that this dominance built on deep market infrastructure and rich developer ecosystems remains robust even as other chains innovate.

Third, the increase illustrates how market cycles can take different forms in the modern crypto era. With more institutional participation, clearer rules of engagement, and maturing infrastructure, digital asset markets are no longer driven solely by retail speculation. Instead, diverse flows of capital including venture investment, strategic collectors, and sovereign or corporate treasuries experimenting with digital ownership are helping shape broader trends in ways that reflect the evolving maturity of the space.

Looking ahead, the question for market participants is whether current NFT momentum can translate into longer-term structural growth. For this to occur, sales increases will need to be supported by deeper liquidity, more repeat participation, and ongoing innovation in asset design and utility. Projects that can demonstrate real-world or cross-platform value such as interoperability with games, membership access, or programmable revenue sharing may lead the next phase of growth.

For collectors and creators alike, the renewed uptick in NFT sales offers both opportunity and caution. While rising sales and Ethereum-led activity suggest expanding interest, the inherent volatility of digital collectibles means that due diligence, community quality, and thoughtful engagement should remain part of any strategy. Those who approach the market with a long-term lens focused on utility, cultural relevance, and sustainable tokenomics may find the current period especially fertile for discovery and participation.

In summary, the 12 percent increase in NFT sales to $67.7 million, driven in large part by a 45 percent spike in Ethereum activity, may be more than just a short-lived bump. It could reflect early signs that the NFT sector is shifting toward more meaningful engagement, diverse use cases, and broader adoption a trend that has implications for both the creative economy and the broader blockchain ecosystem.