Institutional Eyes Turn to XRP as Bitcoin and Ethereum Cool Off

Over the past few weeks, the cryptocurrency world has been watching a subtle but noteworthy shift in investor sentiment. Data from blockchain analytics platforms shows that sentiment around XRP, the native token tied to the XRP Ledger, has climbed to the highest level seen in five weeks. Measures of sentiment typically look at social chatter, positive versus negative mentions, and how much attention an asset attracts relative to others. In this case, XRP sentiment has outpaced that of Bitcoin and Ethereum, even as both of those market leaders remain dominant by market capitalization.

This shift is not just about noise on Twitter or discussion forums. According to recent tracking of crypto fund flows, Bitcoin and Ethereum products have seen significant outflows while XRP has attracted inflows, suggesting a rotation of capital rather than a complete departure from major assets. In simpler terms, some investors who may be pausing on BTC and ETH are placing new bets into XRP or allocating part of their portfolios to it.

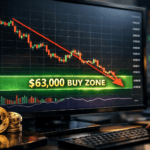

Overall crypto markets remain choppy. Even though sentiment for XRP has improved, prices across most assets have struggled with broader volatility. Analysts caution that sentiment alone does not guarantee price gains, but it does highlight changing mood dynamics among traders and investors.

What Is Market Rotation in Crypto?

Market rotation refers to capital shifting from one group of assets to another. In traditional finance, that might be moving from growth stocks to value stocks. In crypto, it can mean moving from larger assets like Bitcoin and Ethereum into smaller or more specialized tokens like XRP. This does not mean people are abandoning BTC or ETH; rather, it suggests some believe other assets now offer better perceived opportunities or diversification benefits.

Rotation is often most visible when markets are uncertain or consolidating. Money moves away from assets that have had a long run or feel overextended, into those perceived as undervalued or poised for a breakout. What makes the current rotation interesting is that sentiment indicators are showing a relative increase in positive discussion around XRP, unlike Bitcoin and Ethereum, where chatter has been calmer or more cautious.

Why XRP Sentiment Matters

While price remains the most visible metric in crypto markets, sentiment offers a glimpse into how people feel about an asset. Higher sentiment does not automatically mean higher prices, but it can signal a build-up of interest, optimism, and potential increased trading activity. For XRP, rising sentiment reflects not just chatter but also real-world developments that may be fueling investor interest.

One core reason analysts are paying attention to XRP is institutional developments surrounding the token. For example, major exchanges now allow XRP to be used as collateral in lending products, meaning holders can borrow stablecoins without selling their assets. This expands the utility of XRP beyond pure trading and highlights its growing role as a financial instrument rather than just a speculative token.

In addition to lending, the infrastructure around the XRP Ledger (XRPL) continues to evolve. Tools such as permissioned domains and regulated on-chain trading environments aim to bridge traditional finance needs with blockchain transparency. These features may make XRP more attractive to institutional users who require compliance and stable liquidity.

Bitcoin and Ethereum: Sentiment and Flows

Despite their dominance, both Bitcoin and Ethereum have seen a cooling in sentiment relative to XRP. Part of this dynamic may be because Bitcoin and Ethereum have experienced large price swings and drawdowns that have tempered investor excitement. In contrast, a renewed narrative around XRP’s specific use cases and institutional interest provides a fresh storyline for traders and commentators.

Another difference is how flows into ETFs or investment products behave. Recent reports indicate significant net outflows from Bitcoin and Ethereum products in certain time frames, while XRP products showed inflows. Although these flows can change quickly, they support the idea that some capital is reallocating within the crypto asset class.

Still, traders should be cautious. A period of higher sentiment can sometimes precede increased volatility or even short-term pullbacks, especially if prices have already moved. Sentiment is a piece of the puzzle, but it must be considered alongside price action, macroeconomic factors, and on-chain data.

The Role of XRP in a Broader Crypto Strategy

XRP’s improving mood among investors does not automatically dethrone Bitcoin or Ethereum. Both of those assets still anchor the wider crypto market, and many institutional strategies continue to centre on them. However, the fact that sentiment around XRP is stronger relative to BTC and ETH highlights how diverse narratives and use cases can shift investor focus.

For many investors, having exposure to multiple blockchain ecosystems and asset types can help diversify risk. XRP’s relatively unique position tied to cross-border settlement technology, institutional tooling, and expanding collateral use makes it an interesting candidate for those who want exposure beyond the largest two cryptos.

At the same time, broader market contexts such as macroeconomic uncertainty, regulatory shifts, and liquidity conditions play out across the whole industry. These forces can impact all digital assets, not just XRP. Traders looking at sentiment should always balance optimism with awareness of these larger trends.

Final Thoughts, What This Means for Crypto Participants

In summary, the recent rise in XRP sentiment to a five-week high reflects a complex mix of market rotation, evolving narratives, and emerging utility. Capital is moving within the crypto ecosystem, and some investors are seeing opportunities in assets beyond Bitcoin and Ethereum. That said, sentiment is just one indicator among many, and it should be coupled with price analysis, institutional developments, and broader economic context when forming opinions or strategies.

For those watching cryptocurrency markets, the changing sentiment landscape around XRP underscores how dynamic these markets can be. Whether this trend continues or reverses will depend on many factors from trading flows and regulatory developments, to on-chain adoption and macro conditions. Observers should stay informed and cautious, recognizing that sentiment reflects mood as much as it does potential.