Understanding What Happened to Software Developer Protections in Crypto Policy

Today’s sudden breakdown in bipartisan cooperation in the U.S. Senate over crypto regulation stands as one of the most significant political developments in the industry this year. The collapse of what was once seen as a working alliance between Republican and Democratic senators has left crucial protections for software developers uncertain, muddling the path forward for how cryptocurrencies and blockchain technologies will be governed at the federal level.

In this article we’ll break down what happened, why it matters for builders and investors alike, and what could come next in U.S. crypto policy.

Understanding the Senate Crypto Split

For months, crypto advocates hoped that the U.S. Senate would finally produce a unified, bipartisan plan to regulate digital assets. The goal was to balance innovation with consumer protections, clarify which assets fall under which regulators, and shield software developers building decentralized tools from being treated like banks or brokers.

But on January 21, 2026, that cooperation crumbled.

Senate Agriculture Committee Chair John Boozman released an updated draft of a crypto market structure bill that appeared publicly without the full backing of his initial Democratic negotiating partner, Senator Cory Booker. Instead of a jointly branded framework, the new text widened a political divide between different committees and lawmakers.

The dispute now appears to center on how far the government should go in defining digital asset markets, which regulator should govern them, and how protections for software developers should be written into the law.

What Was in the Draft Bill

At the core of the Agriculture Committee’s updated proposal is a framework that would give the U.S. Commodities Futures Trading Commission (CFTC) authority over what it calls “digital commodities” in spot markets, including Bitcoin and other non-security tokens.

This model also seeks to:

Create expedited registration pathways for new market participants under CFTC supervision.

Define terms like “digital commodity intermediaries” that would need to register and comply with rules similar to existing intermediaries.

Potentially treat some tokens such as meme coins as commodities unless regulators later carve them out.

Include protections aimed at keeping software developers out of financial regulatory categories when they are only building or publishing code and not handling customer funds.

These protections for noncustodial developers were seen as vital by many in the industry, because without them, builders of decentralized apps, wallets, libraries, or protocols risk being classified as money transmitters or financial firms.

Why Bipartisan Support Was Important

Bipartisan cooperation was more than a political talking point it was critical for passing major legislation in today’s polarized Senate. A unified bill could mesh the policy priorities of both parties, bridge gaps between the Senate Banking Committee and the Agriculture Committee, and smooth the pathway through the full chamber.

But once the draft bill was released without broad bipartisan sponsorship, lawmakers in other committees felt less compelled to work together on a single framework. The Senate Banking Committee, led by another senator pursuing its own crypto bill, postponed its markup after the failure to coordinate.

At the same time, leaders in the Senate Judiciary Committee have pushed back against key parts of the legislation, especially the software developer protections, arguing that they don’t belong in a market structure bill.

As a result, what once looked like a unified approach to regulating digital assets now looks fractured and uncertain.

Why Software Developer Protections Are a Big Deal

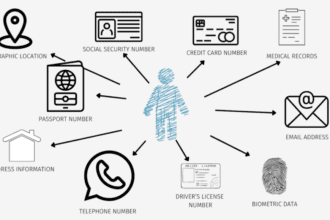

Software developers are the backbone of blockchain ecosystems. They write the code underpinning decentralized finance, smart contracts, wallets, nodes, oracles and protocols that power everything from payments to non-fungible tokens.

Under U.S. financial laws that govern banks, brokers and money transmitters, anyone handling customer funds or facilitating trades is subject to strict compliance requirements. In the context of crypto, regulators and lawmakers have been debating whether developers who do not handle funds should be lumped into these categories.

If these protections are watered down or removed, developers could:

Face costly registration obligations just for building open-source tools.

Be treated as regulated financial entities based on broad definitions of activity.

Be subject to enforcement actions that could chill innovation.

Lawmakers on both sides of the aisle recognized that forcing developers into regulated roles might deter innovation but with the alliance split, the future of these protections is now in limbo.

What Happens Next in Congress

With the Agriculture Committee scheduled for markup later this month, the future of this bill is still in play. But without clear bipartisan consensus, several outcomes are possible:

1. A partisan bill passes Agriculture and moves forward

The Agriculture Committee could move the bill forward along party lines. While this would allow the process to continue, it may make a final negotiated law harder to reconcile with other versions of crypto regulation in the Senate or House.

2. Committees negotiate cross-committee language

Lawmakers could try to reconcile the Agriculture and Banking Committee bills into a joint product. This would require compromise on critical issues such as developer protections, regulator jurisdictions, and how certain crypto assets are defined.

3. Legislation stalls entirely

If differences cannot be bridged, the bill may stall, leaving the U.S. without comprehensive federal crypto regulation and continuing the current patchwork of SEC enforcement and uncertainty in the markets.

In parallel, other proposals like tax reform bills and narrowly focused crypto acts are also being discussed in Congress, so the overall policy landscape may still shift this year.

What This Means for the Crypto Industry

The collapse of bipartisan support is not just a political story. For founders, developers, investors, and everyday users of crypto technologies, the stakes are real:

Regulatory uncertainty could persist, slowing investment and innovation in U.S. projects.

Developers may remain exposed to enforcement or compliance risk, hurting open-source tooling.

Global competitors with clearer frameworks may attract builders away from the U.S.

Market volatility may rise on policy news, affecting asset prices and planning.

Clear rules can help markets grow, while uncertainty often leads to risk aversion. Many in the industry remain hopeful that a pathway to comprehensive regulation still exists — but it will require renewed cooperation among lawmakers.

The sudden implosion of the bipartisan Senate crypto alliance represents a profound moment in U.S. digital asset policy. What was originally envisioned as a cooperative legislative effort to balance innovation, safety, and clear rules has turned into a partisan divide with major implications for software developers and the broader crypto ecosystem.

Whether lawmakers can return to a unified approach or not, the outcome will shape how blockchain technologies evolve in the United States for years to come.

Stay informed, build responsibly, and watch this space because the next moves in Congress could redefine the future of crypto regulation.