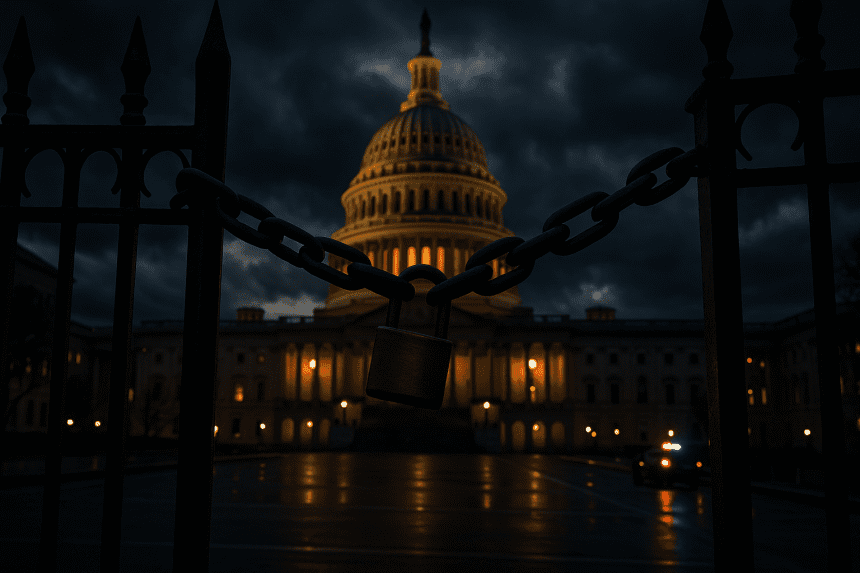

You can almost taste the tension in the air right now. Wall Street’s jittery, businesses are uneasy, and folks at home are quietly checking headlines, wondering if the government’s really about to shut down again. It feels like déjà vu another round of political standoffs where everyone loses a little sleep. So what’s really going on here, and how bad could it get? Let’s talk it through.

A government shutdown sounds dramatic because, well, it is. It happens when Congress can’t agree on funding and the money simply stops flowing. Nonessential federal services close, workers go unpaid, and the whole thing starts to feel like a household that’s run out of cash before payday. And this time, the drama’s dialed up even more. Between political bickering, debt fights, and election-year pride, Washington’s turned into a stage where no one wants to back down. It’s not governing it’s grandstanding.

The effects ripple fast. Federal employees find themselves in limbo, national parks close, and small businesses suddenly can’t access vital loans. The markets? They hate this kind of chaos. Investors rush for cover buying up gold, Treasuries, and sometimes even Bitcoin, just in case. Wall Street dips. Main Street feels it harder. And with inflation still biting, interest rates staying high, and the global economy on edge, the timing couldn’t be worse.

History has already shown how ugly it can get. The 1995–96 shutdown dragged on for three long weeks. The 2013 one lasted 16 days and wiped out roughly $24 billion in economic activity. Then there was the record-breaker 2018 into 2019 a brutal 35 days that left federal workers financially battered and mentally drained. Gold usually comes out looking good, Treasuries see a rush, but if things drag out, even foreign investors start to get nervous about the “world’s most stable” economy.

For regular Americans, it’s not an abstract story it’s their lives. Tax refunds delayed. SBA loans on pause. Food assistance frozen. Military families waiting for paychecks that don’t come. Around the world, people watch the U.S. stumble and start to question its stability. Confidence shakes, markets quiver, trade slows. Even crypto doesn’t escape it sure, some still call Bitcoin “digital gold,” but fear has a way of pulling everything down at once.

Still, there’s one thing markets have always done: bounce back. Once funding deals are made, things usually stabilize faster than you’d expect. Smart investors stay cool, keep their portfolios spread out, and avoid panic selling. Gold tends to keep shining, and crypto—well, sometimes it surprises everyone with a little resilience.

Shutdowns don’t last forever. They pass, like every storm does. But they leave behind something heavier than the economic scars doubt. Doubt in leadership, in process, in whether America can still handle its business like it used to. And that’s the kind of damage that doesn’t just fade with the next paycheck.

Conclusion: The countdown to a U.S. government shutdown feels all too familiar, like watching a slow-motion car crash you can’t look away from. Wall Street’s sweating. Families are anxious. Gold’s grinning in the corner. Crypto’s holding its breath. And the rest of the world? Watching, waiting, hoping someone in Washington finally grows up and ends the cycle. Because the storm will pass it always does but trust? That’s harder to rebuild.