In the world of cryptocurrency, trends move fast. Solana, once known for hosting a wild frenzy of memecoins, is now seeing a sharp pivot. Traders who once chased viral tokens are now turning to something more structured: prediction markets. Instead of speculating on dog-themed coins or meme-powered tokens, people are putting their money into bets on real-world events like elections, economic outcomes, and even sports.

Back in early 2025, memecoins on Solana were booming. In January, trading volumes hit a staggering $169.5 billion. But that hype didn’t last. By November, volumes had dropped to just $13.9 billion a massive 90% drop. This decline wasn’t because of a crash or scandal. It happened quietly. Slowly, traders moved their capital elsewhere. That “elsewhere” turned out to be prediction markets.

At the same time memecoins lost steam, prediction platforms like Polymarket and Kalshi started to explode in popularity. In July, their combined volume was around $1.8 billion. By November, that figure had grown to nearly $8 billion. Prediction markets went from being a small corner of crypto to commanding over half of the volume once dominated by memecoins.

So, what changed?

Let’s start with the difference in how these two markets operate. Memecoins are built on hype. Their value isn’t tied to real-world use or technology. Instead, it’s driven by buzz on social media, from influencers, and among online communities. It’s like a slot machine: fast, flashy, and risky. People jump in hoping to “get rich quick,” but often get burned just as quickly.

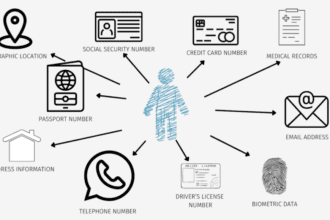

Prediction markets, on the other hand, are grounded in information. They let people place bets on the outcome of real events. Will a certain candidate win the U.S. election? Will inflation rise next quarter? Will Bitcoin hit $100,000 by year-end? Traders can buy “yes” or “no” shares on these outcomes. If they’re right, they earn a payout.

This kind of trading feels more like strategy than pure luck. You win not by chasing memes but by being informed, spotting trends, and reading the world better than the crowd. And that seems to be what many crypto traders are now looking for especially after tiring of the wild swings and rug pulls that come with memecoins.

Solana is at the heart of this shift. Known for its fast, cheap transactions, Solana made it easy for users to trade memecoins in the first place. Now, that same speed and efficiency are powering a new kind of market one focused on knowledge, not just hype.

Another reason for the switch is that prediction markets offer a new kind of “edge.” With memecoins, success often came down to being first first to buy in, first to hype it, and first to sell before the price crashed. But in prediction markets, the edge comes from insight. If you understand global politics, economics, or even niche sports better than others, you can make smarter bets and earn consistent returns.

However, prediction markets aren’t perfect. They still carry risks. Because many of them are still small in size, they can be influenced by a few big players. Someone with enough money could move the market or distort the odds on certain bets. And while volume is growing, it’s not yet at the scale of traditional financial markets. If you want to place big trades, you might run into problems like low liquidity or high price swings.

And let’s not count memecoins out just yet. Even at $13.9 billion in volume, they remain a large part of the Solana ecosystem. The wild appeal of memecoins the thrill of big wins, the community-driven vibes, and the fun of it all is hard to replace. There will always be traders who enjoy the casino-like rush, and they’re likely to stick with memecoins no matter what.

But the bigger trend is clear: crypto traders are evolving. They’re not just looking for excitement anymore. They want purpose, strategy, and maybe even sustainability. Prediction markets offer all of that. They let people bet on the future but with a sense of logic behind each move.

This change also shows how the broader crypto space is maturing. What started as a playground for memes and hype is now becoming a tool for information sharing, decision-making, and real-world analysis. As prediction markets grow, they could even help policymakers, businesses, and researchers understand public sentiment on important issues.

If this trend continues, we could see prediction markets become a major part of the crypto world — just like DeFi or NFTs. Platforms will likely grow, regulations may tighten, and mainstream users might join in once they see the value.

For now, Solana is leading this change. The data proves it. And if you’re a trader, it’s worth paying attention. Whether you’re tired of chasing the next meme or just want to try something smarter, prediction markets could be your next frontier.

In the end, the crypto casino isn’t closing it’s just getting a new game. And this one rewards those who think before they bet.