Why On-Chain Revenue and User Activity Matter More Than Token Price in Solana’s Growth Story

In 2025 Solana recorded one of its strongest years ever not by token price alone but through remarkable growth in application revenue, transactions, and user participation a sign that the network was evolving beyond speculative price swings and building real economic value. According to data shared by Solana’s foundation and confirmed by CryptoSlate, applications and platforms built on Solana generated about $2.39 billion in revenue, an increase of roughly 46 percent year over year and a new record for the ecosystem.

While SOL’s price experienced significant volatility rallying over $250 in early 2025 and then sliding to around $105 before settling near $123 by year’s end the activity across Solana’s decentralized applications told a different story. Users remained deeply engaged with DeFi protocols, trading venues and niche platforms, driving high throughput, deep liquidity and strong network usage despite token price fluctuations.

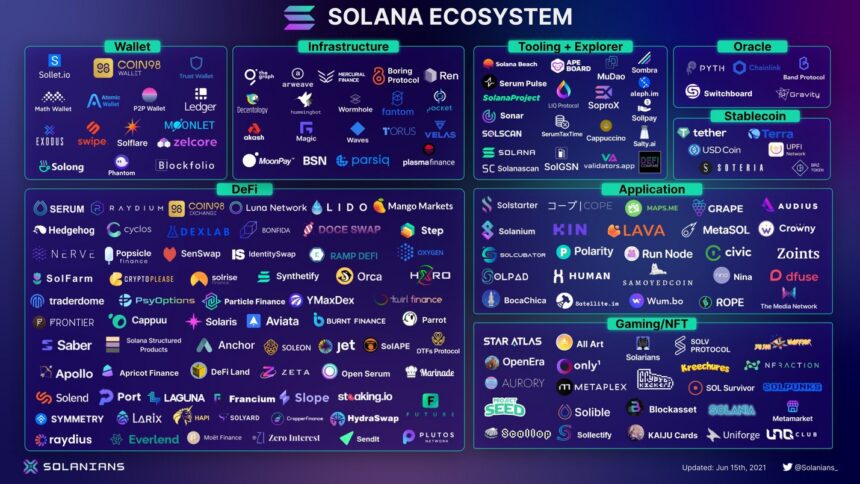

Part of the revenue surge came from well-established Solana applications such as Raydium, Jupiter and Pump.fun which each exceeded $100 million in annual revenue, but the strength of the ecosystem was also visible in the long tail of smaller apps that collectively contributed over $500 million. This diversity of revenue sources signals a healthy and expanding developer ecosystem that is not overly reliant on just a few blockbusters.

The broader network metrics reinforced this narrative of structural growth. Solana processed tens of billions of transactions over the year, with non-vote transaction counts increasing substantially over the prior period, and daily active wallet counts rising to averages well above three million per day another indicator that real users continued to interact with applications across DeFi, NFT, stablecoins and trading services.

Decoupling from price volatility is significant because it suggests that Solana is maturing into an application-driven blockchain where utility and economic throughput matter more than token speculation. Many blockchains see spikes in activity tied directly to token price surges which can evaporate when momentum fades. In Solana’s case the revenue growth and network usage appear to have real underlying substance, driven by user demand and developer innovation rather than short-term hype.

This trend was especially visible in decentralized exchange volume on Solana, which reached new all time figures with more than $1.5 trillion in traded volume showing that traders and liquidity were active even outside macro price trends. Deep and sustained trading activity is an important indicator of a functioning ecosystem that supports both users and developers who build products that customers actually use.

Analysts view this shift as a potential turning point in how the market perceives Solana. Instead of asking whether SOL’s price will outperform other assets, industry observers are increasingly focused on how the network’s financial infrastructure, decentralized applications and real world usage models contribute to its long-term viability. When app-level revenue grows independently of token price, it suggests that the blockchain’s intrinsic economic layer the part that supports transactions, fees and developer incentives may be gaining traction on its own terms.

There are still challenges, like broader market sentiment and periodic network performance questions, but the 2025 data points toward a more mature Solana ecosystem capable of sustaining development regardless of SOL price swings. For users, developers and potential institutional participants this development could mean a shift from thinking of Solana as a speculative token to viewing it as a platform with real economic activity and lasting technical relevance.

As Solana continues into 2026 and beyond, the question for many investors and builders will be whether this trend of application revenue growth can continue to outpace broader market fluctuations. If so, Solana could become a blueprint for how modern blockchains evolve from price-driven narratives to utility-driven ecosystems that support sustainable, long-term engagement