How NFTs Are Transforming Global Investment and Ownership

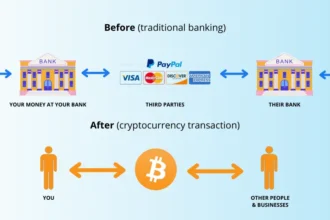

We’re so past the “NFTs are just pictures” stage, aren’t we? They are a material place in finance by 2025 integrated into the fabric that drives capital markets, custody and compliance. These tokens are no longer just toys they’ve turned into smart digital wrappers for real world assets, investor rights and even portable identities. They’re one part lighter, faster ownership and at least part easier to move around. Pretty wild to think about. But let’s not get too excited about it, because behind all this attention is an actual story grounded in data and examples and a frank discussion of the risks inherent in rewiring ownership itself.

FAQs

1.Will I own the copyright to the underlying asset if I buy an NFT?

Not by default. You have the token and whatever rights are mentioned in the legal terms, copyright or phisical ownership needs to be trasferred outside a contract through forms.

2.Why in 2025 would someone buy the Treasury tokenized asset? Concise and high quality instruments will benefit most from 24/7 liquidity and instantaneous settlement perfect OFAC treasury use case or DeFi integrations.

3.Do large institutions ever go on-chain? Yes the big guys have started to lay tokenization roadmaps and put development efforts in place to move funds and RWAs onto-chain.

4.What is the biggest danger of which I am certain to be ignorant? Legal enforceability. Make sure your token’s terms properly attach to off-chain rights and that transfer restrictions and disclosure codes are drafted according to the laws in their jurisdiction.