Who Holds Your Keys? Nevada Closes Fortress Trust After Bankruptcy

The company was placed in receivership by the state of Nevada on October 22, 2025. Regulators discovered it held just $200,000 in cash while owing around $8 million in fiat and another $4 million in crypto. It is the second big Nevada trust-company failure in two years, after Prime Trust was placed into receivership in June 2023. The two firms share a founder, highlighting the widening fractures in lightly regulated crypto custody models.

The collapse also raises a broader question: when crypto platforms claim to offer custody, who actually has your keys? The separation of assets, standards for audits and the safety of infrastructure can fluctuate with regulation or become outdated, leaving users vulnerable in cases where custodians lose.

Nevada’s Financial Institutions Division pulled Fortress Trust from taking deposits or transferring assets, since its operations were “unsafe and unsound.” The business had recently rebranded itself as Elemental Financial Technologies following a 2023 breach at a vendor that they blamed for causing $12-$15 million in losses to over 250,000 customers. Trust funds are to be held under NRS Chapter 669, but enforcement and oversight varies by state.

The Fortress case led to comparisons being made across U.S. custody systems. Nevada retail trusts are legally obligated to segregate assets but receive uneven oversight. New York limited-purpose trusts, which are overseen by the Department of Financial Services there, have also applied tighter regulations including categorizing customer holdings as client property and calling for full audit trails. National trust banks (regulated by the Office of Comptroller of the Currency) are required to meet fiduciary standards and are subject to regular exams. By contrast, Wyoming’s SPDIs have arguably the most stringent segregation requirements, requiring ledger level separateness and record sub-custodianshi p.

The piece emphasises that custody risk is wider than just legal ownership. Failures come on many levels wallet systems, sub custody arrangements, reconciliation processes and third-party vendors. Even solvent custodians can experience crippling losses via frail infrastructure or vendor exposure.

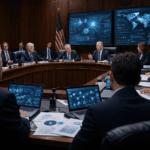

In the wake of Fortress’s collapse, industry players are reexamining their custody strategies. Smaller organizations with less supervision are under higher pressure and cryptocurrency exchanges and asset platforms start going into more regulated jurisdictions such as New York, the OCC or Wyoming. Some, including the likes of Onchain and Hex, are employing multi-provider custody to reduce single point failure.

This wave of failures has also led to a reconsideration of custody contracts. Today, clients also want custodians not to use customer assets anything other than safekeeping for a single value; and books and systems to automatically segregate client holdings, with monthly reconciliations and third party attestations the norm.

The lesson here for individual investors is crystal clear: You cannot just rely on a platform’s marketing. Ask the tough questions what’s the charter for the custodian? Who and how often is it audited? Is the segregation of assets at a ledger level or simply aggregated into omnibus wallets with vendor dependencies? And what if the custodian goes broke before you do how fast could you hope to get your money back, if that’s even possible?