Why Degens Are Funneling into Prediction Platforms as Solana’s Hype Cools

We’ve watched a quiet migration across the degen trenches: capital, attention, and raw risk appetite are pivoting from hyper-speculative Solana memecoin rotations toward event-driven prediction markets. The signal is on-chain and on-platform volumes at leading markets like Polymarket and Kalshi keep chalking up multi-billion-dollar tallies, fundraises and regulatory wins pile up, and market creation trends are setting records. At the same time, Solana’s memecoin engine still formidable has shown fatigue after flash in the pan blow offs and a bruising, high beta drawdown. Data from this year’s cycle shows Solana’s activity can swing from euphoric surges to sharp retracements, especially when the meme tide goes out.

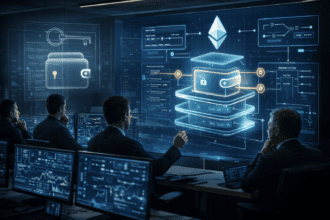

The anatomy of a rotation:When risk cycles flip, traders don’t abandon adrenaline they repackage it. Prediction venues convert macro noise into tradable contracts elections, policy, sports, tech milestones compressing information into prices. That is proving irresistible to the same class of quick-twitch speculators who fed the memecoin meta. The market microstructure is different (order books vs. mint-and-dump), but the dopamine remains familiar: tight spreads, fast feedback loops, and clarity on “what settles when.”

Volumes don’t lie: Hard numbers back the trend. Polymarket’s growth curve over the last 18 months has been steep, with monthly surges into the billions during peak cycles and double digit billions in cumulative volume by mid-2025, according to tracking and industry reporting. Meanwhile, April and May brought all-time highs in new market creation even as trading moderated evidence of structural stickiness beyond any single news burst.

Regulatory tailwinds and why they matter for degens: This cycle’s twist is the regulatory backdrop. Kalshi’s legal wins and fundraising pushed regulated event markets deeper into the mainstream, while reporting this September indicated Polymarket cleared a key pathway to operate in the U.S. a watershed for liquidity and legitimacy. Compliance may sound un degen, but it’s a gravity well for capital: clearer rules can mean deeper books, bigger sizes, and institutional curiosity.

Solana’s memecoin machine still potent, but human: Solana remains a throughput monster and a cultural factory. Its memecoin seasons can dominate DEX volume and flip ETH in bursts. But the aftershock of high profile blow ups and a maturing market often redirect flows toward instruments with firmer settlement and less social engineering risk. Even CryptoSlate’s six month view highlighted how a memecoin crash dented volumes despite SOL’s broader strength classic cyclicality at work.

What prediction markets offer that memecoins usually don’t: We get it memecoins are pure story. Prediction markets, in contrast, are priced stories: they resolve to verifiable outcomes on set dates. That changes trader behavior:

Timeboxed risk is the draw: contracts settle on election night, FOMC day, or earnings calls, so clear deadlines cut narrative drift. Add information liquidity prices move with polls, filings, and data prints so the edge comes from research, not just vibes. With fewer rug vectors counterparty and oracle risks remain, but many tokenomics shenanigans are avoided these mechanics have turned former memecoin swing traders into event risk specialists same reflexes, tighter thesis.

Microstructure: why order books and settlement design matter: Prediction venues rely on robust matching, fee schedules that don’t cannibalize alpha, and settlement credibility. Polymarket’s on-chain footprint plus a refined UX have been crucial in lowering friction, while Kalshi’s CFTC-regulated framework appeals to U.S. users who prize compliance. The combo slick product + regulatory clarity widens the top of the funnel.

The Solana paradox: speed helps memes and drains them faster: Solana’s speed amplifies trend velocity in both directions. When attention and new wallets flood in, memecoin volume eclipses rivals; when the narrative stumbles, the same speed accelerates exits. Past episodes saw daily memecoin volumes whip higher before cooling, and in other months, aggregate on chain volume led the market despite a meme slump proof the chain’s base demand is broader than memes alone. Still, the meme meta is where pain concentrates first.

Prediction markets are surging thanks to macro uncertainty, a lingering “election halo” that keeps activity high, and growing mainstream coverage that attracts fresh capital. While risks remain fragmented liquidity, tricky resolution criteria, and shifting regulations the downside profile differs from thin, reflexive memecoin dumps, which appeals to traders seeking time boxed, event driven bets. Degens are adapting by laddering calendars (CPI → FOMC → earnings), prioritizing real data over chat hype, hedging with pair trades, and timing entries/exits around spread dynamics. For Solana builders, this is a product window ship event tied primitives (oracle-backed markets, parlays, social integrations) with strong stablecoin and compliance rails to capture a ready audience. Memes will return, but the next wave likely blends narrative with clear settlement mechanics. Institutional interest is rising as reputable outlets track volumes and approvals, paving the way for deeper books and tighter spreads. Bottom line: speculation isn’t fading it’s getting smarter, more structured, and anchored to outcomes.

The meta hasn’t died; it’s diversified. As prediction markets professionalize and Solana’s meme engine catches its breath, capital is simply choosing the clearest risk-reward windows available. For now, that window often has an expiry date and a scoreboard.

Citations: Polymarket & prediction market growth and market creation; Kalshi fundraising/volume and U.S. regulatory context; Solana volume and memecoin cyclicality.