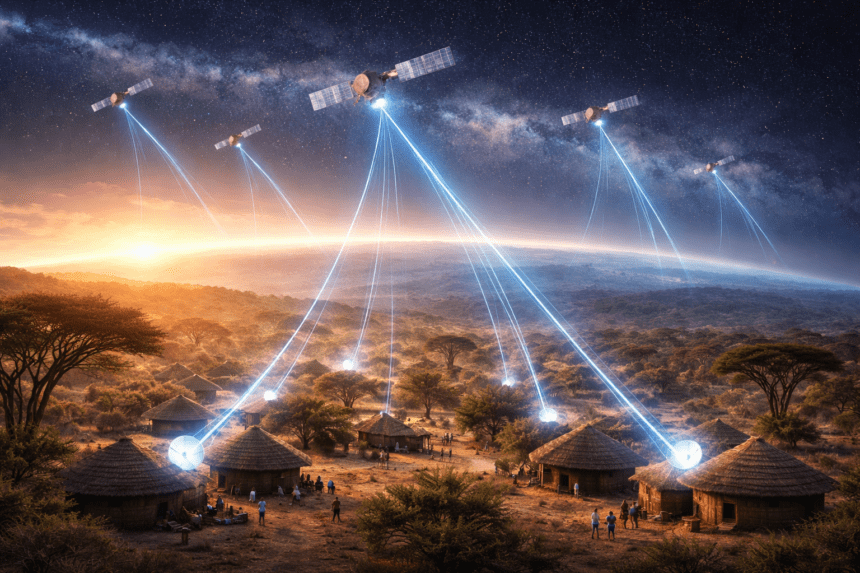

Exploring the new space broadband frontier shaping digital access across the continent

Africa has long faced challenges in connecting its population to reliable and affordable internet. Vast distances, limited infrastructure, and the prohibitive cost of building fiber-optic networks have left many communities offline or underserved. Today, a new path to connectivity is emerging from above: satellite broadband. Two global tech giants Amazon with its Amazon Leo constellation and Starlink from Elon Musk’s SpaceX are at the forefront of a rapidly intensifying competition to bring internet access from space to Africa.

The New Space Race for Africa’s Internet

In early 2026, Amazon received approval to operate its Amazon Leo satellite broadband service in Nigeria, Africa’s most populous country. This licence opens the door for Amazon to deploy thousands of its planned low-Earth orbit (LEO) satellites and compete directly with Starlink, which has already been serving customers in Nigeria and other African markets for years.

For decades, African internet access has depended largely on mobile networks and undersea fiber cables connecting the continent to the wider world. While major subsea cables like Meta’s 2Africa and Google’s Equiano have helped expand bandwidth and reduce costs along coastlines, much of the inland and rural population remains underserved. Satellite broadband promises a different model one that can reach remote villages, nomadic communities, and hard-to-serve regions without building traditional ground infrastructure.

Why Africa Matters to Satellite Providers

Despite progress, Africa remains the least connected region globally. According to international telecom data, about 38% of people across the continent were online in 2024 leaving hundreds of millions without internet access. This vast unmet demand makes Africa an attractive growth market for satellite internet providers.

In places where mobile networks and fiber fail, satellite broadband can offer consistent, high-speed connectivity. Starlink, for example, now operates in more than a dozen African countries and has garnered tens of thousands of subscribers in Nigeria alone, even with premium pricing and hardware costs.

Amazon’s arrival is expected to further expand consumer choices and push competition. The Nigerian Communications Commission (NCC) has issued seven-year operating permits not only to Amazon but also to other satellite entrants, accelerating the pace of broadband rollout across the country.

Starlink: A First Mover in Africa

SpaceX’s Starlink was one of the first satellite internet services to scale internationally and has become a dominant player in Africa’s satellite broadband niche. The constellation leverages thousands of small satellites in low-Earth orbit to deliver broadband with relatively low latency a major advantage over traditional satellite services that relied on higher orbit systems.

Starlink’s presence has been especially impactful in markets where terrestrial connectivity is limited. In several African countries, a Starlink subscription can be cheaper than local fixed broadband offerings, making it a surprisingly cost-effective option for businesses, schools, and households far from urban infrastructure.

Despite its reach, Starlink’s expansion has not been without regulatory hurdles. In South Africa, for instance, licensing rules tied to local affirmative action policies temporarily blocked Starlink’s official entry until regulatory adjustments were introduced to attract foreign satellite providers.

Amazon Leo: A New Challenger

Previously known as Project Kuiper, Amazon Leo represents Amazon’s ambitious plan to build its own global broadband satellite constellation. Amazon has committed to launching more than 3,200 LEO satellites, aiming to provide high-speed internet with low latency and serve regions poorly covered by traditional networks.

Amazon began deploying its first batch of satellites in 2025 and has already shipped user antennas designed to deliver gigabit-class speeds to early testers. The Leo Ultra antenna, for example, is marketed for performance and durability and aims to compete with similar hardware from Starlink.

The Nigerian permit to operate Amazon Leo signals an important milestone, it not only challenges Starlink’s first-mover advantage, but also introduces a major new competitor with vast financial and technological resources. This could reshape pricing, service quality, and coverage in the market.

A Layered Market, Not Just a Head to Head Race

While Amazon and Starlink share the broader goal of expanding satellite broadband, industry experts suggest their strategies may not always be directly competitive. Research indicates that the satellite market in Africa — particularly in Nigeria — might evolve as a layered ecosystem, where different providers focus on different segments or use-cases. Some may target enterprise customers, others may work through partnerships with local telecom operators, and still others may focus on direct consumer broadband services.

This ecosystem approach could help expand connectivity in multiple ways without forcing a winner-takes-all scenario. For example, satellite services might supplement mobile networks in rural areas, support IoT deployments, and offer connectivity for emergency services or maritime communications. Meanwhile, traditional fiber and cellular networks continue to expand and upgrade.

Challenges Beyond Technology

Despite the promise of satellite broadband, several non-technical hurdles remain. Regulatory environments vary across African countries, and licensing fees, spectrum allocation, and local content requirements can all affect how quickly providers can launch and scale. Governments also grapple with concerns about digital sovereignty the idea that control over critical internet infrastructure should reside locally, not in foreign hands.

Affordability is another key issue. While satellite internet can be cheaper than some fixed broadband options, the upfront cost of equipment including satellite dishes and terminals can still be a barrier for many potential users. Providers are exploring rental models, partnership deals with local telecoms, and subsidised hardware to lower these barriers.

Internet access is not just about convenience; it unlocks educational opportunities, healthcare information, e-commerce participation, and broader economic growth. As African populations continue to grow and digital services become ever more essential, the role of satellite broadband providers could be transformative.

The Road Ahead

The arrival of Amazon Leo alongside Starlink in Africa marks a new chapter in the continent’s connectivity story. What began as a groundbreaking idea to beam internet from orbit has now become a competitive arena where global tech giants work to meet local needs. The result could be expanded access for millions who have long been left on the digital periphery.

However, success will depend on a blend of technology, regulation, local partnerships, and pricing strategies that align with African realities. As Amazon, Starlink, and others continue to invest and innovate, Africa’s digital landscape is poised for significant evolution one shaped as much by global ambition as it is by the everyday people who finally get connected.