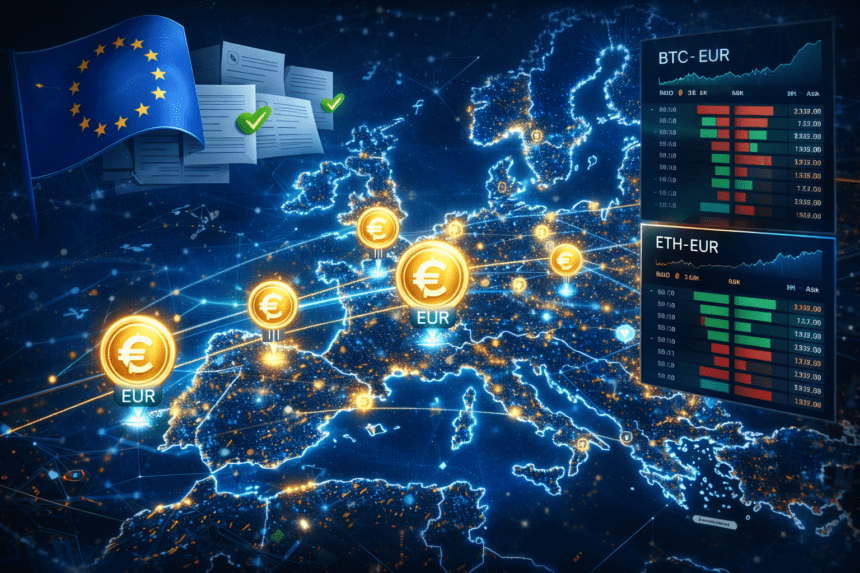

How Regulation Sparked a Euro Stablecoin Boom and What It Means for Bitcoin and Ethereum Trading

In the year since the European Union’s landmark Markets in Crypto-Assets (MiCA) regulation came into force, the euro-based stablecoin market has more than doubled in size, reshaping Europe’s digital finance landscape by attracting fresh trading volume and institutional interest while stabilizing token supply yet the effects on major crypto liquidity, like BTC-EUR and ETH-EUR order books, tell a mixed picture of concentration not universal depth. MiCA’s clear regulatory framework gave issuers and exchanges confidence to support euro pegged stablecoins such as EURS, EURC, and others, prompting monthly transaction volumes to climb nearly ninefold, and reversing past market contraction. However, while euro stablecoins now form a credible rail for cross-border and fiat-crypto settlements, much of the improved trading liquidity remains clustered on a handful of venues with tighter spreads and deeper books, meaning that broader European crypto markets still face execution challenges beyond the headline growth story.

Europe’s Stablecoin Surge: MiCA Doubles Euro Crypto Market

When rules bring clarity, markets follow but liquidity tells a more nuanced story.

G'day I’m Oscar Harding, a Australia based crypto / web3 blogger / Summary writer and NFT artist. “Boomer in the blockchain.” I break down Web3 in plain English and make art in pencil, watercolour, Illustrator, AI, and animation. Off-chain: into combat sports, gold panning, cycling and fishing. If I don’t know it, I’ll dig in research, verify, and ask. Here to learn, share, and help onboard the next wave.