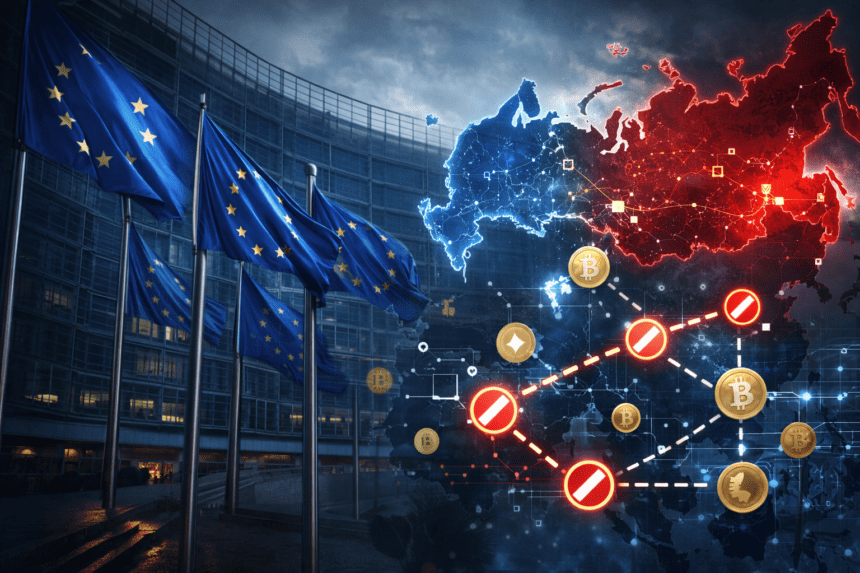

Why One Critical Chokepoint Could Decide Whether Crypto Moves Die or Simply Go Offshore

In early 2026 the European Union dramatically escalated its sanctions strategy against Russia by proposing an unprecedented blanket ban on all cryptocurrency transactions involving Russia. Rather than banning specific Russian crypto firms or sanctioning rogue platforms one by one this ambitious new proposal aims to sever almost every blockchain path that Moscow might use to evade global financial restrictions imposed due to Russia’s invasion of Ukraine. The measure is part of the European Commission’s 20th sanctions package and marks one of the most aggressive steps taken so far to leverage digital asset regulation as a tool of foreign policy and economic pressure.

While the move has strong backing among some member states and policymakers who want to tighten enforcement on Russia’s finances it also raises big questions about technical feasibility enforcement challenges and unintended consequences for global cryptocurrency markets. At its heart the debate centers on a single fundamental chokepoint: whether digital asset flows can genuinely be blocked in a meaningful way or whether they will simply relocate offshore into jurisdictions beyond the reach of Western regulators.

Why the EU Is Pushing a Blanket Crypto Ban

The European Commission’s proposal marks a shift from previous sanctions efforts that targeted individual Russian crypto exchanges like Garantex and the ruble linked stablecoin A7A5 toward a much broader prohibition. Rather than just sanctioning specific entities the new rules would ban all cryptocurrency transaction activity involving Russia or Russian registered crypto asset service providers. This includes trading sending or receiving digital assets via entities tied to Russia and would effectively push cryptocurrencies out of sanctioned networks more comprehensively.

The logic behind this approach is simple: past efforts to sanction individual platforms were often circumvented by successor entities or mirror exchanges that popped up quickly to fill the void once a sanctioned provider was shuttered. Under the new proposal all crypto dealings connected to Russia would be prohibited, aiming to close the loopholes that allowed Russia to continue accessing global financial networks through digital asset rails.

Proponents of the ban argue that digital currencies have increasingly become a workaround for sanctions evasion, allowing capital to flow across borders outside the traditional banking system and avoiding oversight. Crypto’s pseudonymous nature and decentralised structure have historically made enforcement difficult. Arresting or sanctioning one platform often just shifts the activity to another. The blanket ban aims to change that dynamic by creating a unified legal blockade rather than a piecemeal approach.

A Chokepoint That Could Decide the Outcome

But this proposal depends on a key assumption: that the major access points to the global crypto ecosystem can be effectively controlled. That chokepoint includes regulated exchanges stablecoin issuers financial intermediaries and compliance infrastructure that serve as bridges between traditional financial systems and cryptocurrency networks.

The idea is that if authorities can cut off these gateways then it would be much harder for sanctioned users to find routes into legitimate exchanges where they could convert crypto into fiat currency or spend it internationally. For example regulated exchanges in Europe or the United States must comply with anti-money-laundering and know-your-customer rules that make it relatively difficult for sanctioned entities to open accounts or trade without detection. By contrast unregulated or offshore entities often have far looser controls and become hubs for unauthorized flows.

Critics argue that this strategy may not fully work for a major reason: crypto was designed to be borderless and decentralised. Where there is demand there are always alternative gateways and informal corridors that can be exploited. Some hackers money launderers and state actors can use decentralised finance services unregulated offshore exchanges and peer to peer networks to keep moving funds if they are sufficiently determined. This makes enforcement at the chokepoint essential but also extraordinarily difficult if regulators cannot control every entry point.

Put simply the debate is over whether the protocol level of cryptocurrency can still be effectively blocked by targeting regulatory and institutional chokepoints or whether the flows will just relocate offshore to jurisdictions outside the EU’s reach.

How Crypto Became a Sanctions Evasion Tool

Russia’s growing use of cryptocurrency is not a new phenomenon. After Western nations began imposing financial sanctions in response to the invasion of Ukraine in 2022 many analysts observed significant crypto adoption in Russia as individuals and companies looked for alternatives to traditional banking systems that had been restricted by sanctions. In some years sanctioned jurisdictions have been estimated to receive tens of billions of dollars in crypto flows.

Research suggests that Russia has become a major crypto market with millions of citizens holding digital assets and using them as a hedge or cross border transfer mechanism. Some of this adoption springs from broader trends in financial behaviour but a significant portion is directly related to sanctions pressures and limited access to global financial services.

Against this backdrop authorities have tried to adapt. The United States Treasury and European partners sanctioned platforms like Garantex, which was alleged to be a hub for moving Russian money out through crypto and into offshore jurisdictions. Yet even with such measures exchanges have restructured or shifted operations to other markets to continue offering services.

This dynamic is why new policy proposals aim not only at specific firms but at the entire pipeline of crypto flows touching Russia. The European service providers could be prohibited from facilitating wallets transactions or exchanges that directly or indirectly connect to Russian wallets or services. This is an expansive approach that would require tight coordination yet it also highlights the complexity and scale of the challenge.

Enforcement Challenges and Geopolitical Complexities

The proposed crypto ban also illustrates the geopolitical complexity of regulating digital assets across multilateral borders. Unlike traditional financial sanctions that hit bank accounts and corporate structures crypto operates on a network where no central authority exists. This means that even if the EU and its partners impose strict rules there will be pressure points in other regions where compliance is weaker or where geopolitical calculations differ.

Countries beyond Western jurisdictions may be reluctant to enforce similar bans because they see economic or strategic value in being part of the crypto ecosystem. Some nations view digital assets as engines of innovation and growth and are not inclined to outlaw them broadly even when faced with pressure from Western governments. The fear is that a too-aggressive ban could push crypto activity to unfriendly or indifferent jurisdictions effectively hollowing out the ban’s impact.

Another challenge comes from technical enforcement of blockchain transactions. While on chain transactions are visible publicly the identity of wallet holders often is not. Tracking and blocking every transaction that touches Russian entities requires sophisticated analytics intelligence sharing among regulators and cooperation from private companies. Even then actors intent on evading restrictions may use privacy-focused coins tumblers mixers or decentralised networks to complicate tracing and enforcement.

There is also resistance within the EU itself. Some member states have expressed doubts about the scope enforcement readiness or economic impact of a blanket ban. This diplomatic bargaining demonstrates the tension between security policy and economic considerations when dealing with digital assets that are integrated into global markets.

The Broader Implications for Crypto and Sanctions Policy

The Russian crypto ban proposal sends a strong message that governments are willing to consider digital asset restrictions as tools of statecraft rather than solely as market regulation measures. Sanctions are traditionally applied to state banks shipping companies and large corporations but expanding them into the crypto layer signals an acknowledgment of how digital assets can interact with geopolitics.

If the ban becomes law it could set a precedent for how sanctions are applied in the digital age. Future sanctions regimes might include crypto restrictions as a matter of course, closing off avenues that were once thought too decentralized or technical to regulate as stringently. Likewise it may accelerate the development of monitoring and compliance technology for regulators and exchanges alike.

However there are critics who warn that overregulation could backfire by accelerating the development of alternative ecosystems less connected to Western financial infrastructure. This could create a fragmented global digital asset landscape where geopolitical blocs have their own crypto standards and rails. In such a world enforcing sanctions could become even more difficult and markets could split into separate spheres of influence.

What Comes Next

The proposed blanket ban is still a draft and requires approval from all EU member states before it can become law. The fact that it is part of a larger sanctions package highlights how digital currencies have become embedded in broader geopolitical strategies. Observers in the crypto industry regulators and policymakers around the world will be watching closely.

Debate will likely continue over whether such broad measures are effective or necessary. Tech experts will question enforcement mechanisms lawyers will analyse legality and market participants will assess economic impact. Meanwhile nations outside the EU could take divergent approaches that further complicate the global picture. Regardless of the outcome the conversation about crypto and sanctions policy has entered a new and more consequential chapter