Why wallet security is reaching a breaking point and Ethereum is preparing a quiet revolution

For more than a decade cryptocurrency has promised financial self sovereignty. Users were told that if they controlled their private keys they controlled their money. Yet in practice millions of people still rely on what are often called trust me wallets. These are wallets where users assume that the software developer the interface provider or the update mechanism will always act in their best interest. History has shown that this assumption can fail in subtle and catastrophic ways.

In 2026 Ethereum may finally address this contradiction at the protocol level. According to comments from Vitalik Buterin, the solution to trust based wallet risk is not theoretical. It is already shipping. Rather than relying on education warnings or better user behavior Ethereum is embedding safer defaults directly into how accounts work. If successful this shift could permanently change how people interact with crypto and remove one of the largest remaining sources of systemic risk.

This article explains what trust me wallets really are why they persist what Ethereum is changing under the hood and how these changes could reshape security usability and decentralization across the entire ecosystem.

What trust me wallets really are

A trust me wallet is not always custodial. Many are marketed as self custody tools. The issue is not who holds the keys but who controls the rules. In a trust me wallet users must trust that the wallet software will not change maliciously that updates will not introduce hidden permissions and that signing flows accurately reflect what the user is authorizing.

In most popular wallets today a single private key controls everything. That key can sign any transaction approve any contract and drain all funds instantly. The wallet interface becomes the sole line of defense between the user and irreversible loss. If the interface is compromised if a malicious update is pushed or if the user is tricked into signing a complex transaction the wallet offers no structural protection.

This design places enormous responsibility on users who often lack the technical knowledge to evaluate smart contract calls byte by byte. The result is a system where trust is shifted from banks to software developers without removing trust entirely.

Why trust based wallets became the norm

Early Ethereum account design favored simplicity. Externally owned accounts were easy to implement and aligned with the idea of direct ownership. One key one account one owner. This made onboarding fast and aligned with early crypto values.

As Ethereum adoption grew wallets evolved as applications rather than protocol primitives. Features like token approvals contract interactions and decentralized finance access were layered on top without changing the underlying account model. Over time complexity increased while the security model remained static.

The ecosystem responded with education tools warnings hardware wallets and best practices. These helped but did not solve the core issue. A single compromised signature still meant total loss.

Trust based wallets persisted because changing the account model required protocol level coordination. Until recently that coordination was not feasible.

The cost of trust in practice

The history of Ethereum is filled with examples of trust failure. Users have lost funds through malicious approvals phishing sites compromised browser extensions and poisoned transaction flows. In many cases users technically authorized the transaction even though they did not understand it.

These losses are rarely recoverable. They do not require a network hack or protocol failure. They exploit the gap between human understanding and machine execution.

As Ethereum scales and attracts more mainstream users this gap becomes unacceptable. A global financial system cannot depend on perfect user behavior.

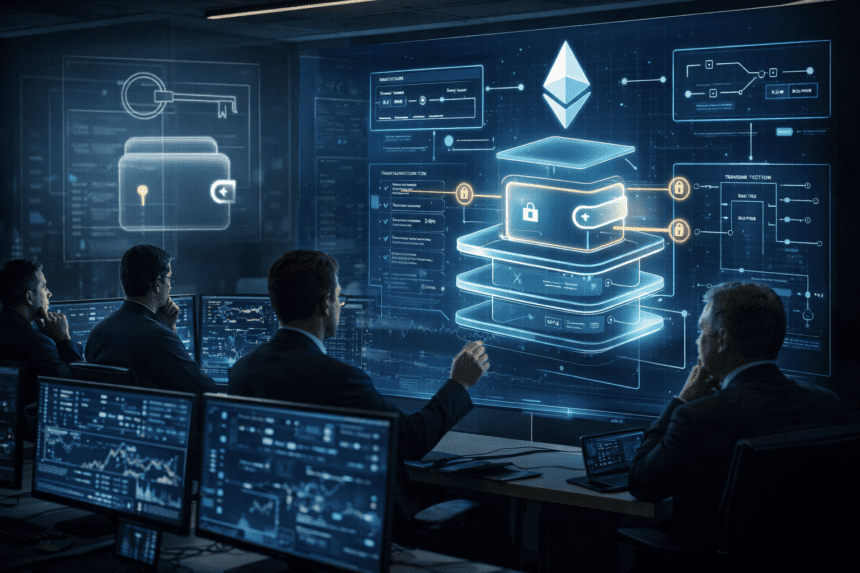

Account abstraction and a new security model

The key change that enables Ethereum to move beyond trust me wallets is account abstraction. This allows accounts to be programmable rather than controlled by a single static private key.

With account abstraction wallets become smart contracts. Instead of a single key having unlimited authority rules can be defined. These rules can include spending limits delayed withdrawals multisignature approvals social recovery and transaction simulation.

This shifts security from user vigilance to protocol enforced constraints. Even if a malicious transaction is signed it may not execute if it violates predefined rules.

This is the foundation of Ethereum’s wallet security upgrade and it represents a fundamental change in how ownership works.

Why 2026 matters

Account abstraction has been discussed for years but practical deployment required multiple upgrades. Ethereum is now reaching the point where these components are live and usable at scale.

In 2026 wallet developers can rely on native protocol support rather than custom workarounds. This lowers friction and encourages adoption.

Vitalik has stated that the fix for trust me wallets is already shipping because the underlying mechanisms are no longer theoretical. They are entering production environments and early user facing tools.

This does not mean all wallets will instantly become safer. It means the ecosystem finally has the ability to build wallets that do not require blind trust.

How smart wallets change user experience

One concern with advanced security has always been usability. Complex security often leads to worse user experience. Ethereum’s approach aims to improve both.

Smart wallets can abstract complexity away from users. They can offer simple recovery flows clear permission boundaries and safer defaults without exposing raw cryptographic details.

For example a wallet can limit how much can be spent in a single transaction. It can require a delay before large transfers. It can allow a trusted contact to help recover access if keys are lost.

These features mirror protections found in traditional finance but without centralized custody.

The end of all or nothing keys

The most important shift is the end of all or nothing private keys. Instead of a single key controlling everything authority can be divided.

This makes wallets resilient to mistakes. A phishing signature might approve a small action but not drain the entire account. A compromised device might not have full power.

This changes the risk profile of self custody dramatically. It turns catastrophic failure into manageable incidents.

Why this matters for mass adoption

Mainstream users do not think in terms of cryptography. They think in terms of safety guarantees. Until now crypto wallets could not offer guarantees comparable to traditional systems.

With protocol level smart accounts Ethereum can finally provide guardrails without sacrificing decentralization. This is essential for onboarding users who are not security experts.

Institutions also benefit. Clear permission models and programmable controls align with compliance and risk management needs.

The broader ecosystem impact

Ending trust me wallets on Ethereum has ripple effects. Other chains will feel pressure to match these guarantees. Wallet standards will evolve. Decentralized applications can assume more secure users.

It also changes the narrative around crypto safety. Losses become less common. Trust shifts from individual wallet developers to open protocol standards.

This does not eliminate all risk. Users can still make poor decisions. But the baseline improves dramatically.

What users should expect next

The transition will be gradual. Many wallets will continue to operate in legacy mode. Education will still matter.

But over the next few years users should expect wallets that feel safer by default. Fewer irreversible mistakes. More recoverability. Clearer authorization flows.

Trust will not disappear entirely but it will no longer be the primary security mechanism.

A quiet but foundational upgrade

Ethereum’s most important changes often happen quietly. They do not generate hype like price movements or token launches. But they reshape the foundation.

Ending trust me wallets is one of those changes. It addresses a structural weakness that has haunted crypto since its inception.

If successful this shift will not just improve Ethereum. It will redefine what self custody means in the digital age.