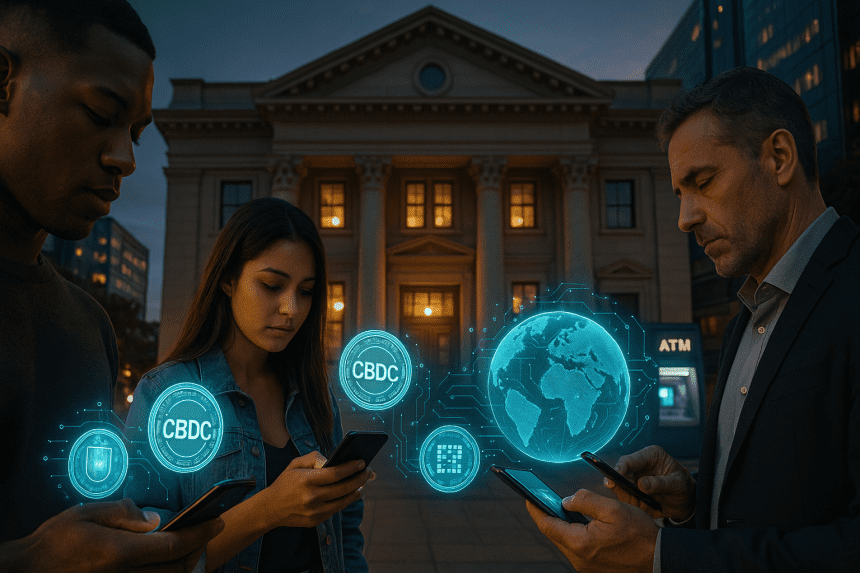

CBDCs started as a talking point and turned into a plan. Central bank digital currencies the state-issued, digital version of a country’s money are moving from pilots to real-world rails next to Bitcoin, Ethereum, and the big stablecoins. In plain terms, a CBDC is digital cash made and backed by the central bank. Same value as notes and coins, different rails. And unlike crypto’s open-ended sprawl, CBDCs are centralized on purpose to update payments, strengthen the plumbing, and carry public trust into software.

The timing isn’t random. Cash use keeps slipping. Cross-border payments are still slow and expensive. Policymakers don’t want to lose the steering wheel while private tokens multiply. So the pitch lands cleanly: faster, cheaper settlement; easier access for anyone with a phone; clearer audit trails against crime. Most designs come in two flavors retail (for everyday spending) and wholesale (for interbank settlement). Whether they run on a blockchain, a conventional database, or a hybrid setup matters less than the outcomes: secure transactions, smart features like time-bound or conditional payments, and just enough traceability to deter abuse without overwhelming people.

You can see why this is tempting. Local payments clear in seconds. Transfers abroad arrive in minutes. Fees fall as layers of intermediaries thin out. And if a crisis hits, the government can push help straight into digital wallets with fewer leaks. But there are trade offs. Privacy is a real worry because digital money leaves footprints that cash never did. The same visibility that helps catch crime can slide toward surveillance if guardrails fail. Cybersecurity risk goes from local to systemic when one breach could rattle a nation’s money layer. Banks might lose deposits if people choose to hold CBDCs directly. Building and running these systems is expensive, and uneven global rollouts can add new friction even as CBDCs try to remove it. That’s the tension.

Crypto sits on the other side permissionless, community run, sometimes wild. CBDCs are official money with policy levers, legal clarity, and institutional support. Different tools for different jobs. Crypto is the experimental, programmable asset world; CBDCs aim to be the public payment rail that “just works.” And the rollout is already visible: China’s e-CNY in large pilots, the Bahamas’ Sand Dollar live, Nigeria’s eNaira focused on inclusion, Sweden’s e-Krona testing life with less cash, and the European Central Bank moving toward a digital euro. As projects scale, roles shift. Banks may rethink their models. Card networks face new pressure. Governments gain sharper tools to deliver policy. Consumers get faster, cheaper, more accessible payments if the experience is simple and trust is earned.

Cross-border is where the big leap could happen. Today’s correspondent chains are slow and fee-heavy. CBDCs could enable direct currency swaps between central banks or shared corridors that settle almost instantly, cutting costs for businesses, migrants, and families. Designs will differ some blockchain, some centralized, some hybrid but the winners will be interoperable, secure, and so usable that most people barely notice the machinery underneath. That’s the goal digital public money that hums in the background, alongside cash and private rails, improving efficiency and inclusion without giving up the freedoms that make money trustworthy.

So, excited or worried? Probably both. Done well, CBDCs can modernize payments, widen access, and make public money ready for a digital century. Done poorly, they risk turning into an always on ledger of our lives or squeezing out private innovation. Reality will likely land in the middle. CBDCs are coming. The responsibility is to ship them with privacy by default, security by design, and governance that resists mission creep. If those guardrails hold, the way money moves could change as profoundly as the internet changed how we communicate.