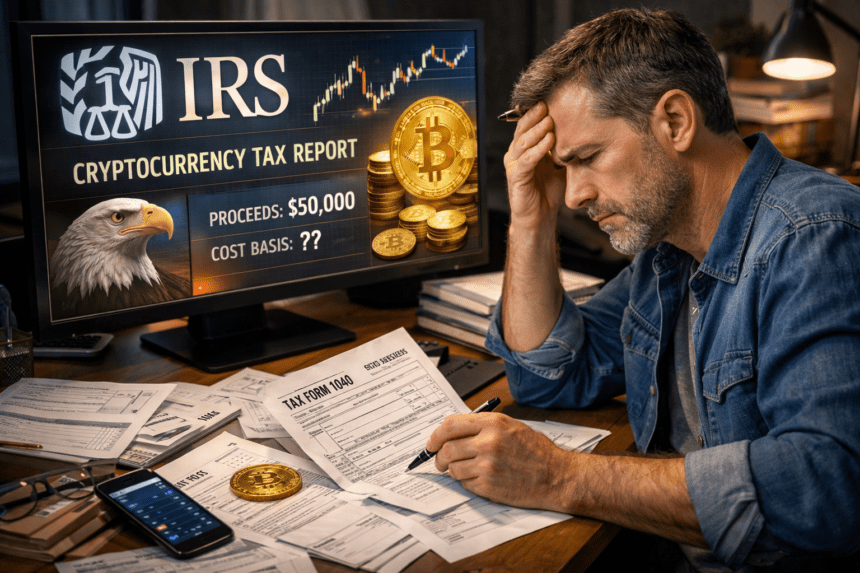

How new IRS rules make your Bitcoin gains more visible and potentially taxable

Cryptocurrency investors in the United States are facing a growing sense of unease as the IRS sharpens its focus on digital asset transactions. The latest development comes from a new reporting requirement that makes crypto sales more transparent to tax authorities, sparking what many are calling a Bitcoin tax panic. As millions of people traded, sold, and swapped Bitcoin and other digital assets in 2025, the IRS now has a clearer view of those transactions and can match them against what you report on your tax return and that means extra scrutiny for gains you may not have tracked properly.

What Has Changed With Crypto Reporting in 2025

For the first time, many crypto brokers and exchanges are sending taxpayers and the IRS a new form called 1099-DA, which reports the gross proceeds from digital asset sales during the 2025 tax year. That sounds straightforward, but here’s where the complication begins: while these forms show how much you sold for, they often do not include your cost basis what you originally paid for the asset. This gap creates confusion and potential tax pain for investors with complicated trading histories.

The IRS began rolling out this change at the start of 2025, and forms are already arriving in early 2026 as people prepare to file their tax returns. Brokers generally report your proceeds without necessarily knowing the full history of how you acquired the coins. If you bought Bitcoin across multiple wallets and exchanges or moved crypto into self-custody before selling, that original cost information may not be on the report. That means you not the IRS or the broker are responsible for figuring out and proving what you paid for those coins.

Why This Is Causing Panic

The concern among crypto holders stems from the mismatch between what the broker reports and what the IRS expects you to calculate. If you simply import your 1099-DA into tax software and hit submit without correcting the cost basis details, you could end up reporting larger taxable gains than you actually incurred. For example, if your 1099-DA shows $50,000 in proceeds and your true cost basis was $40,000, a simple import might treat the entire $50,000 as gain leading to higher taxes and unnecessary tax payments.

This risk inflates worries because many investors did not keep meticulous records of every transaction, especially those involving transfers between wallets, decentralized exchanges, or cross-platform swaps. For people who treated crypto casually or used multiple venues over the years, the paperwork can feel like a puzzle they are now forced to solve.

How the IRS Sees Your Crypto Activity

Cryptocurrency transactions are not hidden from tax authorities the way some might assume. The IRS collects data from exchanges that have to comply with Know Your Customer (KYC) and anti-money-laundering rules. These exchanges report user details and transaction activity directly to the agency, which can then match that information with what is filed on your tax return. In addition to exchange reporting, blockchain transactions are permanently recorded on public ledgers that sophisticated analytics tools can track and link to identities.

This transparency has grown over time. Exchanges have been issuing 1099 forms for years, and the new 1099-DA is an evolution of that reporting system with a stronger focus on digital assets. What once was mostly voluntary reporting of crypto activity has now become more formalized and detailed.

What You Must Do Before Filing

If you invested in Bitcoin or any other cryptocurrency during 2025, it’s crucial to take the following steps before filing your tax return:

1. Gather All Records of Your Transactions

Start by collecting every relevant document that shows how much you paid for crypto, including trade receipts, wallet records, and exchange downloads. If you transferred assets between wallets or services, make sure you can trace the cost basis back to the original purchase.

2. Understand How Basis Is Calculated

Cost basis is the amount you originally paid for an asset, including fees, and it determines your taxable gain or loss when you sell. Without this key number, the IRS may treat your entire sale as profit, which results in higher taxes. Keeping clean records now can save significant headaches later.

3. Use Crypto Tax Tools or Professional Help

Many cryptocurrency tracking tools are available that can automatically compile your trading history and calculate accurate cost basis figures based on your activity across platforms. Alternatively, a qualified tax professional can guide you through this complex reporting landscape and help ensure you don’t overpay or trigger red flags with the IRS.

The Bigger Picture for Crypto Investors

The IRS considers digital assets like property, meaning every sale, swap, or transfer that results in a gain or loss can have tax consequences. The requirement to answer whether you have engaged in digital asset transactions is now a regular part of the federal tax return, and failure to report accurately can result in notices, adjustments, and potential penalties.

While the new reporting system could seem overwhelming, it’s part of a broader trend toward integrating digital assets into standard financial reporting frameworks. Governments and tax authorities globally are seeking more transparency and more accurate data about cryptocurrency transactions. This trend is likely to continue as digital currencies become a larger part of the financial ecosystem.

Conclusion: Don’t Wait Until It’s Too Late

If you sold Bitcoin or any other cryptocurrency in 2025, ignoring the new rules isn’t an option. The IRS already has more visibility into your trading activity than ever before, and relying solely on what a broker reports can cost you money. Meticulous record-keeping, proper cost basis tracking, and professional guidance will be your best tools this tax season.

Understanding how these tax reporting changes affect you now will not only prevent mistakes but also help you build a compliant and confident approach to cryptocurrency investing in the future.