Something is flipping in the world of bitcoin mining. The old faith that you can “stack sats” to fight wealth inequality is dying, replaced by something more ambitious build for AI or be left behind. Miners who once prayed for block rewards are now praying for demand from tech giants, launching IPOs and constructing data centers and describing those concerns not in terahashes but rather in megawatts.

They’ve sent about $5.6 billion of BTC to exchanges, not because they’re selling out, but because they’re buying in to something greater. Turning coins into capital. Repaying ancient debts, wiring new substations and trading hash rigs for GPU clusters. It’s survival with a blueprint.

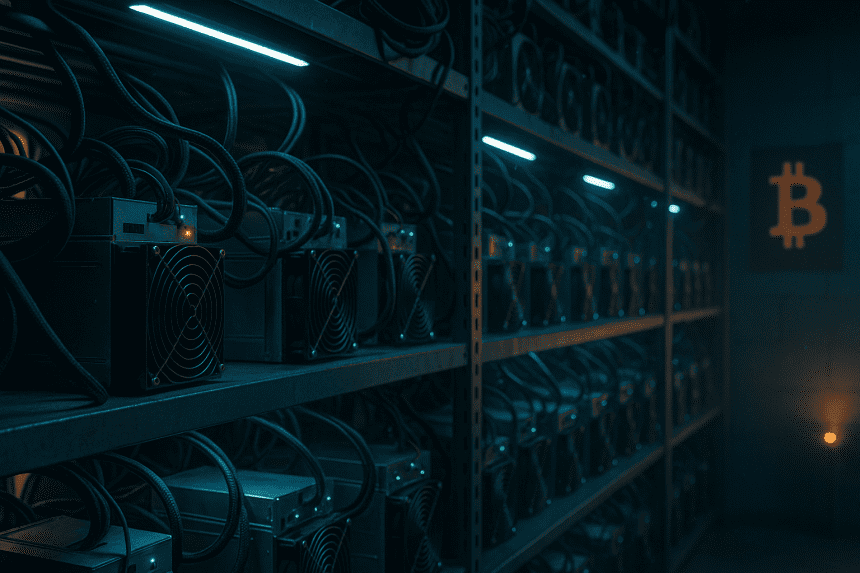

Margins have always been tight. But now, with halvings squeezing and energy prices ascending, AI might appear to be the lifeline miners never knew they were missing. They have the land, the power and the cooling systems already what any AI company would kill for. The transition just makes sense.

The would-be merger of Core Scientific with CoreWeave underscores the growing importance of miner infrastructure. Hut 8’s rebranding, Marathon’s energy-grid crossover all of it proof that mining is mutating into something grander and more stable, maybe even smarter. And Texas? Still the heart of it all. Now the same cheap power that is fueling Bitcoin’s rise is being used to outraise AI companies.

So yes, miners are selling BTC. But they’re not bailing they’re buying time, buying progress, buying the future. Because these days, in this new race, the one who controls the power doesn’t merely keep the lights on. They write the story.