When capital finds a way, Bitcoin becomes the bridge.

What the $436M Hong Kong Filing Could Mean for Crypto and Capital Flows

Bitcoin and global capital markets have entered a new era. In early 2026 an obscure Hong Kong financial firm revealed it held about $436 million worth of shares in BlackRock’s US-listed Bitcoin ETF, sparking questions: Is this simply institutional interest in Bitcoin, or is it part of a subtle shift of Chinese capital into crypto markets through a regulated channel?

This article explores what happened, why the filing matters, how Hong Kong fits into the picture, and what it could mean for Chinese investors and the broader crypto ecosystem.

What Happened: The Laurore Filing

In February 2026, a rarely-heard-of Hong Kong company called Laurore Ltd filed a disclosure with the United States Securities and Exchange Commission (SEC), showing it held 8,786,279 shares of the iShares Bitcoin Trust (IBIT) a Bitcoin ETF managed by BlackRock.

At roughly $436 million in value, this stake represents about 0.65 % of the ETF’s total shares outstanding a material position for a newcomer.

Crucially

Laurore has no digital footprint, no website, and little public information available.

Its director, named in the filing as “Zhang Hui,” has a very common name, making it hard to trace beneficial owners.

The structure looks like an offshore holding vehicle, possibly based in the Cayman Islands or British Virgin Islands, common jurisdictions for cross-border investment funds.

This opacity, combined with the scale of the position, has led some market observers to speculate about who is really behind the investment and why.

Why This Filing Matters

There are several reasons this filing caught the crypto world’s attention:

Bitcoin ETFs are a major institutional gateway into crypto for regulated investors who don’t want to manage private keys or use unregulated exchanges.

Seeing a large position owned by a Hong Kong entity raises questions about the flow of capital out of China into Bitcoin via Western financial markets.

China’s official stance on crypto remains prohibitive direct Bitcoin trading and ownership by mainland individuals and institutions is not permitted.

If this filing reflects actual Chinese capital, it could signal a new informal channel for exposure to Bitcoin without direct ownership.

The situation is intriguing because it highlights a possible regime arbitrage strategy: using regulated financial products in foreign markets to gain exposure that is effectively forbidden or restricted at home.

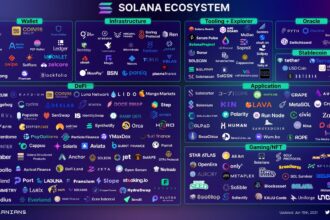

A Broader Pattern: Hong Kong as a Bridge

Laurore isn’t an isolated case.

Earlier filings have shown other Hong Kong-based companies reporting substantial holdings in Bitcoin ETFs, including:

Avenir Tech Ltd, which disclosed over 14.7 million IBIT shares, roughly $691 million in value in a 2025 filing.

Yong Rong Asset Management Ltd, another Hong Kong filer with exposure, albeit smaller.

These filings point toward a pattern where entities situated in Hong Kong a global financial hub with a different regulatory landscape from mainland China are increasingly holding large positions in US-listed Bitcoin ETFs.

Why Hong Kong?

Hong Kong’s regulators have adopted a more permissive approach to digital asset infrastructure than Beijing, including licensing virtual asset service providers and enabling access to global markets.

Mainland China continues to enforce a broad ban on crypto trading and related services, even as Hong Kong positions itself as an Asia-Pacific crypto finance hub.

This “One Country, Two Systems” arrangement gives financial players in Hong Kong access to capital from greater China while still operating under international securities rules.

These factors make Hong Kong a logical place for capital that wants exposure to regulated Bitcoin instruments without violating Chinese domestic restrictions.

Does This Mean China Is Buying Bitcoin Through US ETFs?

Not necessarily and this is important.

There is no verified evidence that the Laurore position itself represents direct mainland Chinese state capital or official institutions. The filing shows ownership but doesn’t disclose the ultimate beneficial owners.

Here’s what we do know

China’s official policy remains hostile to crypto trading and private ownership. Beijing’s regulators have reiterated that cryptocurrencies are not legal tender and that trading and related services are banned.

Hong Kong, though part of China, operates a separate financial and securities regime that has been more open to innovation, including digital assets.

So while the Laurore and similar filings highlight a connection between Hong Kong financial entities and US Bitcoin ETFs, that doesn’t prove Chinese banks, state funds, or official institutions are covertly buying Bitcoin through ETFs. What it does possibly suggest is this:

Investors with access to capital in Greater China, whether international firms, private wealth managers, or family offices, may be using this route to gain exposure to Bitcoin without running afoul of domestic restrictive policies.

So in short: Yes, some capital with links to Hong Kong and potentially China seems to be entering Bitcoin markets via regulated US ETFs. But it’s not confirmed that this is driven by Chinese government policy or state funds.

What Makes Bitcoin ETFs Attractive

Spot Bitcoin ETFs like BlackRock’s iShares Bitcoin Trust (IBIT) have exploded in popularity in the US and globally because they offer:

Regulated exposure to Bitcoin price movements without needing to custody crypto directly.

Lower friction for institutional investors, such as hedge funds and asset managers, who may have policy mandates restricting direct crypto holdings but can invest in regulated products.

Liquidity and transparency, with daily trading data and reporting.

IBIT itself has become one of the largest Bitcoin ETFs in the world, with tens of billions of dollars in assets under management.

This has made it appealing to large capital holders looking to express Bitcoin exposure at scale.

The Geopolitical Angle

Bitcoin is increasingly entangled in global financial geopolitics.

The United States now hosts some of the largest publicly traded Bitcoin exposures via ETFs and corporate holdings, and its adoption of regulated crypto products has helped funnel global capital into these vehicles.

China, by contrast, has taken a restrictive stance on cryptocurrency trading and ownership, yet maintains massive influence in the global crypto ecosystem through past mining dominance and financial markets.

Hong Kong occupies a strategic middle ground:

Close links to mainland capital,

A more open regulatory environment for digital assets, and

Access to international markets via structures like ETFs.

Whether this positioning will translate into large-scale capital flows from China into Bitcoin through ETFs remains speculative but the Laurore and Avenir filings have certainly stirred discussion.

Is This Good or Bad for Crypto?

There’s no simple answer it depends on perspective.

Potential positives

More institutional interest can lead to greater liquidity and price stability.

Regulatory clarity from established markets like the US can bolster confidence.

Hong Kong’s role may encourage wider Asian participation in digital finance.

Possible concerns

If capital is effectively circumventing domestic bans, it could raise regulatory and compliance issues.

Questions about transparency and beneficial ownership remain unresolved.

Heavy participation by opaque entities could introduce unknown risks.

In any case, the situation underscores how financial innovation and regulation interact in complex, global markets.