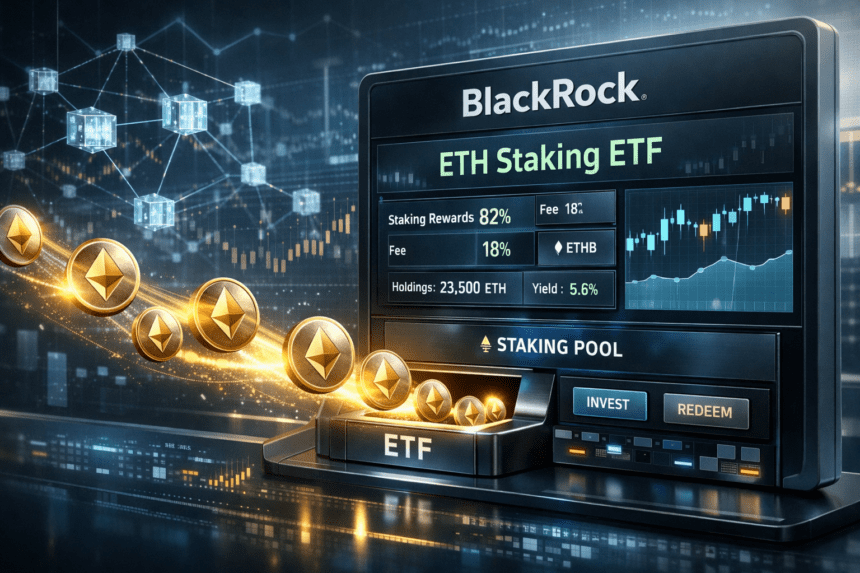

BlackRock brings Ethereum staking to Wall Street, but investors pay the price before the rewards arrive.

In recent news, BlackRock’s proposed Ethereum staking exchange-traded fund (ETF) has captured the attention of the crypto and traditional finance worlds alike, especially after a high-profile filing revealed a notable fee structure that could shape how staking rewards are distributed to investors. This development adds a new chapter in the ongoing integration of decentralized blockchain income into regulated financial products. Here’s a clear and factual breakdown of what’s happening, why it matters, and what investors should consider moving forward.

What Is the iShares Staked Ethereum Trust ETF?

BlackRock, the world’s largest asset manager, has filed an updated registration statement with the U.S. Securities and Exchange Commission (SEC) for a staked Ethereum ETF, tentatively called the iShares Staked Ethereum Trust ETF (ticker: ETHB). This fund is designed not simply to track the price of Ether (ETH) like a traditional spot ETF, but also to earn staking rewards on behalf of its shareholders by actively staking most of the ETH it holds.

Under the current filing, BlackRock plans to stake approximately 70% to 95% of the ETF’s Ethereum holdings. A portion of ETH will remain un-staked to maintain liquidity for redemptions and operational needs.

How Staking Rewards Will Be Divided

One of the biggest headlines from the filing is that the ETF would retain 18% of gross staking rewards generated by the staked ETH as a form of fee before distributing the remainder to investors. This total 18% fee reflects a combined take for BlackRock as sponsor and the prime execution agent responsible for coordinating the staking operations.

Put simply, if the staking process earns rewards on the ETF’s ETH holdings, investors can expect to receive about 82% of those rewards after the 18% deduction. On top of this reward cut, the ETF would also charge a management or sponsor fee, calculated annually on the fund’s net asset value. The filing lists this fee at 0.25% per year, though BlackRock plans to temporarily waive it down to 0.12% for the first $2.5 billion in assets for a period of 12 months after launch.

Why This Matters for Investors

1. Yield vs Price Exposure

Traditional spot ETFs allow investors to gain exposure to the price movements of an asset like ETH without directly owning it on-chain. A staking ETF introduces yield generation as an additional benefit, potentially turning a price-only product into one that also produces income. However, the 18% cut of rewards means investors receive a reduced effective yield compared to staking ETH themselves on the open network.

2. Liquidity Considerations

Staking on Ethereum comes with protocol-level constraints — notably, unstaking or “exit” mechanisms that can take weeks to complete under certain conditions. This could impact how quickly ETF holders can redeem shares for cash or underlying ETH, depending on market demand and liquidity buffers the fund keeps.

3. Industry Precedent

If approved, this ETF would represent one of the first major attempts to bring staking rewards into a regulated, tradable investment vehicle in the U.S. financial system. That could set a precedent for other asset managers and institutional products, potentially expanding the way mainstream investors access blockchain-native income streams.

Potential Pros and Cons

Pros:

Access to Ethereum staking rewards without managing validators or node infrastructure.

Institutional backing from BlackRock and trusted infrastructure from partners like Coinbase Custody Trust.

Automated reward reinvestment and ETF packaging could simplify investing.

Cons:

Investors only receive ~82% of staking rewards due to the 18% cut.

Additional sponsor fees reduce net returns further.

Liquidity timing tied to staking exit mechanics could delay redemptions during volatile markets.

Thoughts

BlackRock’s move to introduce a staking-enabled Ethereum ETF signals growing institutional interest in combining yield-based crypto mechanisms with regulated finance products. While the 18% staking reward fee has generated debate among investors, it reflects the cost and complexity of operating such a fund at scale. For some, the simplicity and security of a regulated staking product will outweigh the costs. For others, on-chain staking outside of a fund structure may remain more attractive.