How a Trump Family Backed Financial Venture Seeks to Change Remittances

In February 2026, the crypto and finance worlds took notice when World Liberty Financial a digital finance company backed by members of the family of U.S. President Donald Trump announced plans to launch a new platform called World Swap. Designed to handle foreign exchange and international remittances, World Swap aims to make sending money across borders cheaper and faster by using blockchain technology and a dollar-pegged stablecoin called USD1.

The news pushed attention beyond crypto circles into markets, politics, and regulatory debates. Some see this development as a potential breakthrough in global money transfers. Others view it through a governance and ethics lens, questioning whether the proximity of the U.S. presidency to World Liberty Financial creates a conflict of interest or a risk to public trust.

What World Swap Is and Why It Matters

World Swap is being pitched as a new foreign exchange and remittance platform. That means it would help people and businesses send money across borders and exchange currencies, but in a way that could be cheaper and faster than traditional banking and remittance companies like Western Union or banks that often charge high costs and take days to settle transfers.

The idea, according to co-founder Zak Folkman, is that there are trillions of dollars moving between currencies every year, and traditional systems “tax” users with fees and slow settlement. By using blockchain technology and its own USD1 stablecoin, World Liberty Financial says it can settle cross-border transfers at a fraction of the cost of traditional systems.

World Swap is not yet live; the announcement came at the Consensus Web3 conference in Hong Kong, and the company said it plans to launch the platform soon.

How World Swap Could Work

The company hasn’t published a full technical blueprint yet, but based on how similar platforms operate and the details shared publicly, the basic flow might look like this:

A user funds a remittance in their local currency using a bank transfer or card.

The platform converts that currency into USD1, a stablecoin designed to stay equal to one U.S. dollar.

The USD1 is moved over blockchain settlement systems to the recipient’s region.

The USD1 is converted back into the recipient’s local currency and delivered to their bank account or debit card.

This model could potentially reduce fees and delay because it sidesteps multiple intermediary banks and settlement layers.

The Scale of the Opportunity

To understand why this matters, it helps to look at the numbers:

Worldwide foreign exchange markets handle trillions of dollars of activity daily, a figure measured in trillions of dollars per day of trading. Meanwhile, remittances money sent by workers to family overseas total hundreds of billions annually.

In this context, even modest improvements in cost and speed could benefit millions of people especially migrant workers, small businesses, and families receiving support from abroad.

What Is USD1 and Why It Matters

USD1 is the stablecoin that World Liberty Financial has developed and intends to use as the settlement asset for World Swap. Stablecoins are cryptocurrencies designed to hold a stable value in this case, pegged to the U.S. dollar by backing them with real-world assets, cash reserves, or other financial instruments.

Because USD1 is designed to stay close to one U.S. dollar in value, it can be used as an intermediary without exposing users to the price swings commonly seen in other cryptocurrencies like Bitcoin and Ether.

The broader ecosystem around USD1 includes World Liberty Markets, a lending platform that reportedly processed hundreds of millions of dollars in lending and borrowing activity shortly after launch in late 2025.

Why Some People Are Excited, There are several reasons why World Swap has generated interest, Lower Fees and Faster Transfers.

Traditional remittances are expensive. Banks and transfer services often charge multiple percent fees plus marked-up exchange rates, meaning a significant portion of the money never reaches the intended recipient. If World Swap can genuinely deliver transfers at a lower total cost, that can be a real benefit for users.

Access to Modern Financial Rails

By leveraging stablecoins and blockchain settlement, World Swap could offer an alternative to slow correspondent banking, especially in regions with less effective financial infrastructure. Faster settlement could mean money arrives in minutes rather than days.

Increased Competition

New entrants force established players to innovate. If World Swap brings competition to foreign exchange and remittances, incumbents may cut their own fees and improve services as a result.

Real Challenges and Risks to Watch

Despite potential benefits, there are clear challenges and risks:

Regulatory Uncertainty

Cross border payments and remittances are highly regulated in most countries. Anti money laundering laws and know your customer requirements must be met in every market where World Swap operates. Failure to do so can result in fines, shutdowns, or loss of banking partners.

Even if the technology works, obtaining regulatory approval across multiple jurisdictions is complex.

Stablecoin Trust and Transparency

Stablecoin schemes are only as credible as the reserves backing them. Users need clear, audited information about how USD1 is backed, how redemptions work, and what protections exist if markets become stressed. Lack of transparency can lead to loss of confidence.

Competition and Adoption

Even if World Swap offers lower costs in theory, gaining trust and widespread adoption is hard. Established players already manage billions of transactions with long track records.

Systemic Risk

Stablecoin based platforms are still new relative to traditional banking rails. In times of market stress or liquidity crunches, stablecoin systems can behave unpredictably unless they have strong risk controls.

Academic studies of stablecoin ecosystems show how fragile or resilient these systems can be depending on how they are backed and integrated with traditional financial infrastructure.

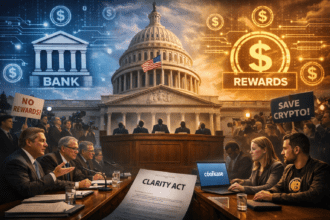

“The Political and Ethical Context”

One of the most talked about aspects of World Swap is not the technology itself but who is behind the company launching it.

World Liberty Financial is not a typical fintech start-up. It is a decentralized finance venture backed by members of the family of U.S. President Donald Trump.

That means this initiative sits squarely at the intersection of business, finance, and politics and that raises important ethical questions.

Ethical Pros and Cons in Plain Language

Here is a clear, straightforward look at what people mean when they discuss the ethics of a platform like World Swap being so closely linked to the presidency.

Ethical Pros: Why Some People Say It Can Be Good

Lower Costs Help Ordinary People

If World Swap truly reduces remittance costs, that could benefit families sending money home, small businesses paying partners overseas, and workers supporting loved ones.

Innovation Benefits Everyone

Competition and innovation in payments markets can be beneficial. New technology can force incumbents to improve services for all users.

Global Financial Access

Stablecoin-based rails could bring financial access to people who lack traditional banking services.

None of these points depend on the politics of who owns or backs the company. They are benefits that can accrue from better financial tools.

Ethical Cons: Why Some People See a Problem

Conflict of Interest

When a sitting President’s family is financially tied to a company that could benefit from regulatory decisions, it raises questions about whether policy will be shaped to support that company rather than the public interest. This concern goes beyond speculation it touches on public trust in government.

Perception Matters

Even if there is no improper action, the appearance of influence can erode confidence in the fairness of regulation and markets. People need to trust that rules are applied equally to all, not shaped for narrow interests.

Foreign Influence Concerns, There have been reports of foreign investment stakes and deals involving World Liberty Financial including large investments from entities tied to foreign governments which has intensified scrutiny about whether outside actors could gain leverage over U.S. policy.

Institutional Trust Risk, Financial systems depend on confidence. If ordinary users believe that powerful insiders have special deals or regulatory advantages, they may question the neutrality of the system.

In simple terms, critics argue that governments and business ventures should remain sufficiently separate so that public policy serves the broader public interest, not narrow interests.

Should the Government Be This Close to a Private Finance Company?

This is a bigger question than just World Swap.

Many ethics frameworks including those used by governments and watchdog groups recommend clear separation between public office and private financial interests, especially in sectors that are regulated by the government. The reason is simple: to avoid even the appearance that policy is being shaped to benefit a connected private entity.

When a financial services venture especially one with global reach is backed by close family members of a sitting President, and regulatory policy affecting stablecoins and crypto is evolving under that same presidential administration, critics see a high risk of conflict of interest or regulatory capture.

Supporters argue that as long as legal safeguards are in place (such as blind trusts or independent oversight committees), the company’s existence is legitimate. But many ethics experts say that legal compliance is the minimum standard, while maintaining public trust and institutional integrity requires even greater separation.

Most professional ethical standards would advise that leaders avoid financial entanglements that overlap directly with their regulatory authority. If the policies that affect an industry also benefit someone in power or someone close to that power people naturally question whether decisions are fair.

What Users and Observers Should Look For

Before treating World Swap as a mainstream option, everyday users, journalists, regulators, and investors should monitor:

Regulatory Approvals and Licensing: Where World Swap is authorized, and under what rules.

Stablecoin Backing: How USD1 is backed, audited, and redeemable at par.

Fee Transparency: Real delivered costs versus advertised costs.

Consumer Protections: How disputes, fraud, and errors are resolved.

Data Privacy: How user data is handled and protected.

Governance and Conflict Safeguards: What independent oversight exists to separate policy influence from private profit.

These factors matter more than any marketing or political narrative.

Pros and Cons Summary

Pros

Potentially lower remittance costs and faster transfers

Increased competition in global money movements

Possible financial access for underserved populations

Innovation in payments using blockchain and stablecoins

Cons

Regulatory uncertainty across borders

Trust and transparency issues with stablecoin backing

Competition from established players

Political and ethical concerns about conflicts of interest

Potential risk to public trust in financial system