Why Crypto Rewards Could Be the Price of Progress

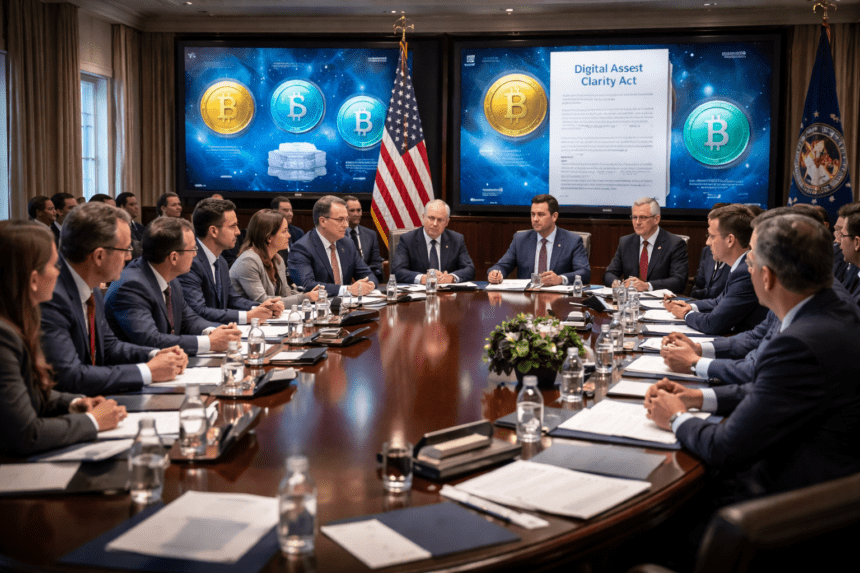

The cryptocurrency world is watching Washington, DC closely this week as a pivotal White House meeting could finally unfreeze the stalled Digital Asset Market CLARITY Act a law long awaited by investors, builders, and industry leaders seeking regulatory clarity in the United States. What makes this negotiation especially dramatic is the potential tradeoff on the table: stablecoin reward programs, a popular incentive for crypto users, may be the price paid for progress on federal regulation.

Cryptocurrencies are an ecosystem of innovation, decentralisation, and new economic models. Yet without clear rules of the road, uncertainty has slowed institutional involvement and left investors guessing how regulators will classify digital assets. The CLARITY Act aims to change that by creating a defined legal framework for digital asset markets clarifying what counts as a security or commodity, how stablecoins are regulated, and how self custody rights are protected.

However, at the heart of current negotiations is a heated debate over whether crypto companies should be allowed to offer interest like rewards on stablecoin balances. Banks say these rewards resemble traditional deposit interest and could draw funds away from the banking system, while crypto firms argue that rewards help attract users and fuel innovation. This clash has left the bill stuck in procedural limbo until now.

What Is the CLARITY Act and Why It Matters

The CLARITY Act (formally H.R. 3633) is a proposed U.S. law designed to establish comprehensive and clear regulation around digital assets, including cryptocurrencies, tokens, and stablecoins. Originally passed by the House of Representatives in mid-2025, it has been sitting in the Senate Banking Committee awaiting further action. Its supporters say it would finally give the crypto industry a long-sought legal framework, helping define which assets are regulated by the Securities and Exchange Commission (SEC) vs the Commodity Futures Trading Commission (CFTC) and replacing regulation by enforcement with written rulemaking.

One of the key purposes of the CLARITY Act is to protect consumer rights and encourage innovation by creating transparency in how digital assets are treated under federal law. It also includes provisions to protect self custody rights meaning individuals could hold their own private keys without unwanted interference. The bill also attempts to outline how decentralised finance (DeFi) activities should be treated, carving out specific language stating that some software and protocols remain outside its scope if they meet certain criteria.

For crypto businesses and investors alike, the potential passage of the CLARITY Act represents clarity after years of regulatory uncertainty. Many firms have delayed product launches or held back investment due to unknowns around enforcement and compliance. Passing this law could encourage greater innovation and adoption, and position the U.S. as a competitive hub for digital finance.

The Stablecoin Reward Controversy

At the center of the current negotiation is a sticking point that has frustrated both regulators and industry leaders: stablecoin rewards and interest like payouts. Stablecoins are digital tokens pegged to the U.S. dollar, like USDC or USDT, and many platforms offer rewards for holding them often marketed as “yield” or “rewards” for users. For example, some crypto exchanges advertise annual reward rates on USDC balances of several percentage points.

Banks and traditional financial institutions argue that such rewards are too similar to bank deposit interest, and fear that widespread adoption of high-yield stablecoin products could pull deposits out of the banking system. They contend that allowing unregulated or lightly regulated entities to offer these incentives could destabilise the broader financial system.

Crypto companies counter that these programs are not interest in the traditional sense, but rather loyalty, rebate, or activity-based rewards. They also argue that stablecoins are fully reserved and that high yields don’t carry the same risks as fractional reserve banking products. Removing these incentives, many in the crypto world say, could make the space less competitive and slow user adoption.

Because of this debate, the Senate Banking Committee postponed a markup session originally scheduled to consider revisions to the CLARITY Act. The current White House meeting is aimed at breaking that deadlock by finding a compromise that satisfies both regulators and crypto industry representatives.

Possible Paths to Compromise

As negotiators seek middle ground, one emerging possibility is a compromise approach to stablecoin rewards. Under this plan, programs that are tied to user activity such as spending rewards on crypto cards could remain permissible, while passive yield on held balances could face limitations or new compliance requirements. Such a solution would shift the landscape toward incentive structures tied to actions rather than pure balance based payouts.

This kind of split would allow reward programs that encourage economic activity, such as cashback on spending through crypto debit cards, to continue while addressing regulators’ concerns about products that resemble deposit interest. It might preserve many consumer benefits while satisfying legislative intent to protect the financial system.

Still, the compromise is not guaranteed. If negotiators cannot resolve the debate over stablecoin rewards, the CLARITY Act could remain stalled or be reshaped with stricter rules that reshape how crypto products are marketed and offered in the U.S. market.

Why This Moment Matters

For the broader crypto ecosystem, this week’s White House negotiations are significant. Passing the CLARITY Act would represent progressive policy action that could provide much needed regulatory certainty and help the U.S. maintain leadership in digital finance. Clarity on how digital assets are regulated would encourage institutional investment and pave the way for new products and services.

However, the outcome of these discussions could also reshape rewards, incentives, and how crypto platforms compete with traditional banking. If rewards are curtailed or redefined, companies will likely redesign products and marketing to align with the new legal definitions, potentially changing user expectations and earnings strategies.

This intersection of regulation and innovation highlights a broader challenge in financial policy: how to balance consumer protection, systemic stability, and innovation. Finding a path that respects all three will define how crypto evolves in the U.S. over the coming years.

What to Watch Next

As the week unfolds, key signals to monitor include:

Whether negotiators produce draft language on stablecoin rewards that could be attached to the CLARITY Act text.

If the Senate Banking Committee schedules a new markup session with revised bill language.

How lawmakers, regulators, and industry leaders react publicly to any proposed compromise.

What definitions lawmakers settle on regarding interest, rewards, and yield in the context of digital assets.

The answers to these questions will go a long way in determining whether the CLARITY Act moves forward as a realistic piece of law or remains tangled in debate.

In short, this is not just a legislative moment it’s a turning point in how digital assets and traditional finance interact under U.S. law