A Deep Look at How States Are Taking on Crypto-Linked Prediction Markets

The world of crypto and financial innovation is once again colliding with established law and regulation, this time in the U.S. state of Nevada. Recently, Nevada regulators moved to block Coinbase from offering its new prediction markets product in the state, arguing that the contracts the platform offers should be treated as unlicensed gambling rather than legitimate trading instruments. This action comes on the heels of a high-profile dispute with Polymarket, another major prediction market operator that was temporarily barred from offering event contracts to Nevada residents by a state court ruling.

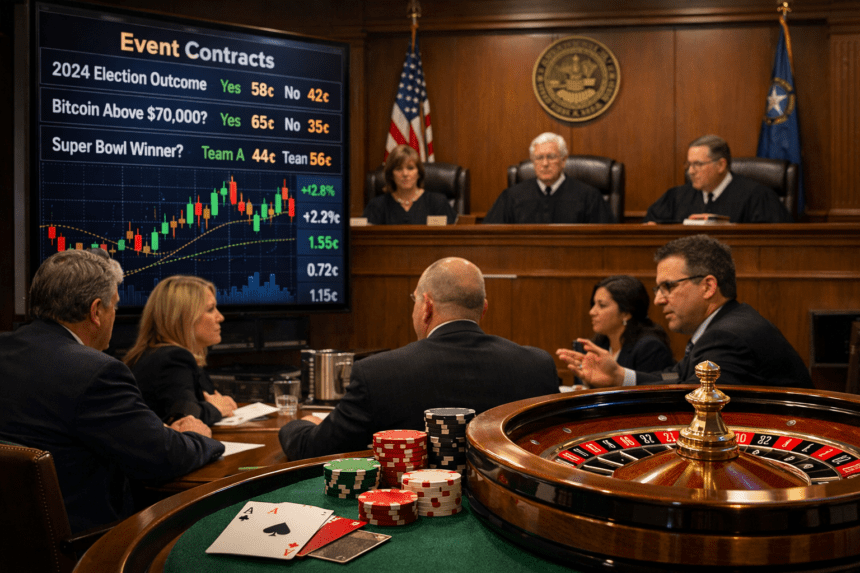

Prediction markets enable participants to buy and sell contracts tied to future outcomes. These can range from election results and sporting event winners to cultural or economic events. The price of a contract typically reflects the market’s collective view of the likelihood of a particular outcome, and users profit if their predictions turn out to be correct. But what should happen when the mechanics of these markets appear similar to traditional bets? That question is at the heart of the legal battle unfolding in Nevada.

What Nevada Regulators Are Arguing

Nevada’s gaming authorities, led by the Nevada Gaming Control Board, have taken Coinbase to court, asserting that the exchange’s event-based contracts, including those tied to sports and political outcomes, qualify as gambling under state law. The regulators claim that these prediction markets operate like wagering, require licensing under Nevada’s stringent gambling statutes, and should be subject to the same protections and restrictions that govern casinos, sportsbooks, and bookmakers in the state.

The regulators also pointed out that Coinbase allows users aged 18 and older to trade in these markets, which they argue conflicts with Nevada’s legal gambling age of 21. They have requested injunctive relief and a permanent halt to the offering of these prediction contracts unless and until Coinbase obtains appropriate licensing.

Coinbase’s Position and Broader Legal Context

Coinbase, on the other hand, maintains that its prediction market offering should fall under federal oversight specifically the jurisdiction of the Commodity Futures Trading Commission (CFTC). The exchange launched access to these markets through a partnership with Kalshi, a CFTC-regulated event contract market, and argues that these products are exchange-traded derivatives rather than traditional gambling instruments. In doing so, Coinbase says it is operating within a regulated framework meant to protect customers and ensure financial compliance.

This conflict is not isolated to Nevada. Other states, including Massachusetts and Tennessee, have also challenged prediction markets from operating within their borders, issuing cease-and-desist orders to platforms like Kalshi, Crypto.com and Polymarket alike. Many have cited concerns that these platforms mirror traditional sports wagering and fall outside the scope of federal oversight as intended by the CFTC.

The legal tug of war between federal regulators and state gaming authorities hinges on the interpretation of the Commodity Exchange Act and whether it preempts state gambling laws. Some federal courts have ruled that CFTC-regulated event contracts should not be subject to state law enforcement, while others have sided with states, emphasizing the protection of local gaming integrity and consumer safeguards.

The Role of Polymarket’s Ban

Nevada’s action against Coinbase is part of a broader trend of regulatory pushback against prediction market platforms. Earlier this year, a Nevada state court granted a temporary restraining order blocking Polymarket from offering contracts to Nevada residents. The judge sided with state regulators who argued that Polymarket’s offerings constituted unlicensed wagering under state law, rejecting the notion that federal commodities law completely preempted local gaming enforcement. Polymarket subsequently suspended access in the state during the legal proceedings.

Polymarket itself is a notable crypto-based prediction market founded in 2020. It has historically allowed users to trade contracts tied to a wide array of real-world outcomes, and at one point was one of the largest markets by volume. However, the platform has been subject to regulatory bans in multiple countries due to similar concerns about unregulated gambling, and it temporarily had to geo block U.S. users due to prior enforcement actions.

Why This Matters for Crypto and Innovation

The Nevada dispute highlights broader questions about how emerging financial technologies should be regulated. Prediction markets sit at the intersection of finance, technology, and gaming. They provide price signals based on collective opinions and can, in theory, serve as powerful forecasting tools. Yet because they resemble betting, regulators in different jurisdictions are wrestling with how to classify and oversee them.

Supporters of prediction markets argue that bringing them under established financial oversight like that of the CFTC can provide consistency, transparency, and risk management. They also argue that federally regulated frameworks could promote innovation and growth while protecting consumers. Critics counter that without clear consumer protections and licensing obligations, prediction markets could expose everyday users to gambling-like risks without adequate safeguards.

In addition to regulatory battles, prediction markets have faced scrutiny for other issues as well. Some independent reporting suggests they can inadvertently spread misinformation or incentivize trading on sensitive geopolitical or public news events. These dynamics add another layer of complexity in how regulators and society choose to treat them.

The Future of Prediction Markets in the U.S.

As of early 2026, the legal environment for prediction markets remains in flux. Nevada’s aggressive posture could set precedent for other states considering similar actions. Meanwhile, at the federal level, the CFTC has signaled that it plans to develop clearer rules for prediction markets, potentially clarifying how these products should be overseen and reducing ambiguity between federal and state jurisdiction.

How courts, regulators and lawmakers ultimately balance consumer protection, innovation, and economic opportunity in this space will have implications far beyond Nevada’s borders. Will prediction markets be treated as gambling requiring state licenses, or will they gain acceptance as regulated financial products? The answer will help define the future of a rapidly evolving corner of the financial and crypto ecosystem.