Why this matters even if you have never used crypto before

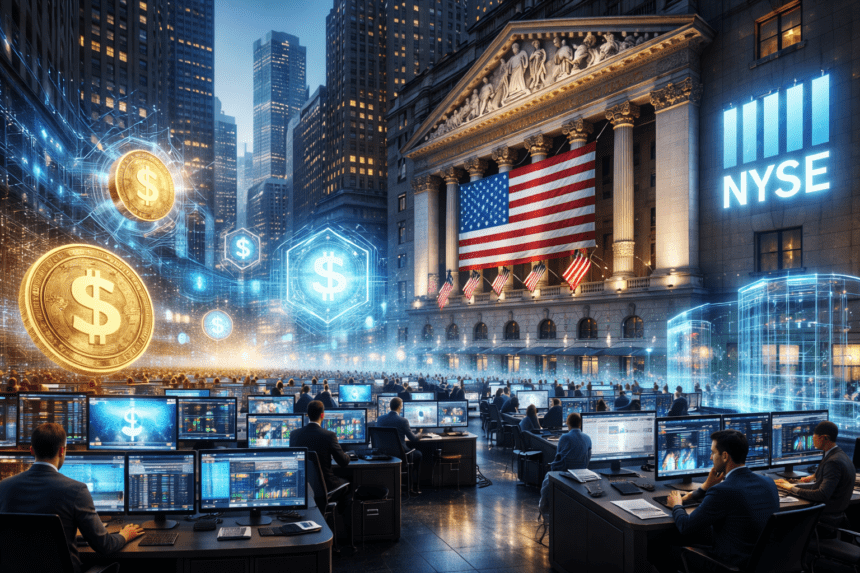

A quiet revolution is unfolding in global finance. Big Wall Street firms are no longer just watching cryptocurrencies and blockchain technology from the sidelines. They are beginning to use this technology to reshape how money moves, how markets operate, and even how dividends are paid to investors. In a recent announcement, the New York Stock Exchange (NYSE) revealed that it is building a new blockchain based platform designed to support 24-hour trading and on chain settlement of tokenized stocks and exchange traded funds using stablecoins digital currencies designed to stay the same value as traditional money like the US dollar.

This shift may seem highly technical, but the implications reach far beyond Wall Street traders. It touches how everyday investors receive payouts, how fast markets can operate, and how traditional finance and digital finance are blending into a single system.

In this article we will explain what this development means, how it might work, and why stablecoins, tokenization, and blockchain systems could become the backbone of future financial markets.

What Is Happening with Wall Street and Blockchain

The NYSE the most famous stock exchange in the United States announced its intention to launch a new platform built on blockchain technology. According to public reporting, this platform is intended to support trading and settlement of tokenized US stocks and ETFs around the clock, not just during traditional market hours.

Tokenized stocks are digital representations of traditional financial assets. Instead of holding shares in paper or through conventional electronic records, ownership is recorded as tokens on a blockchain. These tokens behave like traditional shares, but they exist on a distributed ledger that can be accessed and verified by many computers around the world.

The NYSE platform is being designed to combine its existing order matching engine with blockchain post trade systems. This hybrid approach allows the same reliability and regulatory compliance Wall Street expects, while also enabling new features like instant settlement and the use of stablecoins as the funding asset.

Stablecoins: The Digital Dollars of the Blockchain World

Stablecoins are digital assets that are usually tied to the value of a traditional currency, like the US dollar. Unlike more volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins aim to maintain a steady value. This makes them especially attractive for financial applications where price stability matters.

In the context of the NYSE’s new platform, stablecoins could be used to fund trades and move money instantly across time zones outside of normal banking hours. This would reduce the friction and delays typically associated with stock market settlement cycles, which currently take at least one full day (often referred to as T+1 settlement).

By using stablecoins as settlement assets, the platform could allow trades to be finalized in real time, every hour of every day. This kind of “always on” market would be a stark contrast to the traditional model where most after hours trading and settlement waits for central bank and banking system windows to open.

Dividends Could Become Faster and More Transparent

One of the most interesting aspects of the NYSE’s proposed blockchain platform is how dividends might be paid. Traditional dividend payments can take days to move from a company’s coffers into investors’ brokerage accounts. A blockchain system could potentially push those payments instantly, using stablecoins or tokenized cash equivalents.

This means that investors could receive payouts the moment a company declares a dividend, without waiting for multiple layers of intermediaries to process the transfer. Standard dividend instructions and governance rights the basic features that shareholders expect would remain intact, but the underlying payment method could be far faster and more efficient on chain.

For everyday investors this does not necessarily mean you will receive crypto instead of cash. Instead, it likely means that your brokerage could process and deliver your cash payout far more quickly and transparently behind the scenes.

Instant Settlement and 24/7 Markets

The move to instant settlement marks one of the biggest potential changes in the history of markets. Today most exchanges operate on a schedule that is dictated by traditional banking systems. Trades made after market close must wait until the next business day or beyond to settle. With blockchain enabled settlement, those constraints could disappear.

The NYSE platform is being developed to allow trading every hour of every day, with settlement happening instantly or near instantly. A key ingredient of this design is the use of stablecoins and other blockchain native funding assets that can support settlement outside traditional banking windows.

This concept is already drawing reactions from major players across the financial world. Some market participants see the transition as an important modernization step, while others warn that the power dynamics and value capture might still favour traditional institutions over decentralized networks.

What Tokenization Means for Investors

Tokenization is the process of converting ownership rights of an asset into a digital token on a blockchain. For stocks and ETFs, this means that ownership and transfer of those assets can happen in digital form, with each token representing a share or fraction of a share.

Tokenization has several potential advantages:

Fractional ownership: Smaller investors can own tiny slices of expensive assets.

Transparency: All transactions are recorded on a ledger that is visible to all participants.

Reduced clearing friction: Settlement can occur without waiting for a central authority.

These benefits could lead to new models of investing, where assets become more accessible and markets become more efficient.

Companies like Securitize, Inc. already operate in this space by tokenizing real world assets and offering services that bridge traditional and blockchain based finance.

Regulatory and Technical Challenges

Despite the promise of instant settlement and tokenization, major regulatory and technical challenges remain. The NYSE must still seek approval from key regulators before the new platform can launch, and permissioned access rules may apply to ensure customer protections and compliance with existing financial laws.

At its core, this platform aims to maintain regulatory compliance while delivering the operational advantages of blockchain. This means systems must handle identity verification, custody requirements, anti money laundering controls, and real time reporting to regulators.

Moreover, the integration of stablecoins into mainstream financial plumbing raises questions about oversight. Regulators have been increasingly focused on stablecoin frameworks, with new laws and guidelines emerging that require issuers to maintain strict reserves and transparency.

The Broader Trend: TradFi Meets Blockchain

The NYSE’s blockchain initiative is part of a much wider trend where traditional finance embraces the possibilities of distributed ledger technology. Big banks, asset managers, and financial institutions are exploring tokenization, programmable finance, and digital asset settlement in ways that were unimaginable a decade ago.

For example, large banking firms are experimenting with tokenized funds that pay dividends or interest using stablecoins or blockchain based structures. These developments suggest that tokenization and blockchain systems may not be limited to niche financial products but could become mainstream infrastructure over time.

This shift does not mean traditional markets will disappear, but it does indicate that future financial systems may operate faster, more transparently, and with new kinds of digital assets coexisting alongside cash.

Why It Matters for You

Even if you are not a sophisticated investor or cryptocurrency enthusiast, this evolution matters. Faster settlement times and blockchain enabled market infrastructure could reduce costs, improve transparency, and create new opportunities for everyday investors.

It could also influence how financial institutions operate behind the scenes, from clearinghouses to brokerages. If markets become more efficient and settlement becomes near instant, traditional lags in liquidity and transfer could become relics of the past.

The use of stablecoins as settlement assets also highlights that digital currencies may become an integral part of financial systems, not just speculative tokens. As regulators catch up with technological changes, frameworks that ensure consumer protection and financial stability will be central to how these systems develop.

Conclusion

Wall Street’s move towards blockchain powered markets is a major moment in the history of finance. By combining the reliability and oversight of established exchanges like the NYSE with the speed, transparency and flexibility of blockchain and stablecoin technology, the financial world is being reshaped in real time.

The promise of instant settlement, 24/7 trading, and tokenized ownership opens doors for faster dividend processing, more efficient markets, and broader investor participation. At the same time, regulatory and technical hurdles must be overcome to ensure that these changes benefit the entire ecosystem without compromising safety and compliance.

As this technology rolls out and regulators grapple with new models of finance everyone from everyday investors to institutional giants will be watching closely. Whether this represents a future dominated by digital assets, or a hybrid system where traditional and blockchain based systems coexist, one thing is clear: the era of blockchain powered finance has arrived.