In early January 2026 the state of Tennessee set off a major legal and regulatory dispute that could shape the future of prediction markets across the United States. The state’s Sports Wagering Council (SWC) issued cease-and-desist orders to three prominent platforms Kalshi, Polymarket, and Crypto.com’s prediction market services — demanding they immediately stop offering sports-related event contracts to Tennessee residents and refund all customer funds by January 31 2026. Tennessee regulators argue that these contracts function as unlicensed sports betting under state law and pose risks to consumers and public safety.

This action has since snowballed into a high-stakes legal confrontation over who regulates prediction markets in America: federal authorities through the Commodity Futures Trading Commission (CFTC) or individual states via their gambling laws. The dispute highlights fundamental questions about the nature of event-based contracts how they are treated under US law and how far states can go when federal oversight exists.

A State Takes Aim at Prediction Markets

On January 9 2026 the Tennessee SWC sent formal regulatory letters to Kalshi Polymarket and Crypto.com ordering them to halt the offering of sports event contracts to people located in Tennessee. The letters assert that these platforms are operating unlicensed sports betting businesses and in violation of the Tennessee Sports Gaming Act which mandates licensing for all entities accepting wagers on sporting events. Regulators warned that failure to comply could lead to escalating civil penalties potential criminal action and the forced refund of all customer deposits by the end of January.

The language in the cease and desist orders was direct: the platforms’ contracts are not compliant with state consumer protection requirements and pose “an immediate and significant threat to the public interest of Tennessee” if they remain available without appropriate gambling licenses. Tennessee regulators pointed to issues such as underage betting inadequate player protections and shortfalls in anti money laundering controls that they say distinguish prediction markets from federally regulated financial derivatives.

For Kalshi Polymarket and Crypto.com this represented yet another state enforcement action following similar moves in states such as Nevada Arizona Illinois Maryland and New Jersey where regulators previously challenged their operations. Some previous rulings have sided with states classifying these contracts as gambling while others have been less decisive leaving considerable legal uncertainty.

Prediction Markets Under Federal and State Law

The core of the dispute is a conflict between federal authority and state control. Kalshi and similar platforms operate under federal registration with the CFTC as designated contract markets meaning they are authorized to list and trade derivatives contracts including event-based contracts on a nationwide basis. From the companies’ perspective these contracts even those tied to sports outcomes fall under federal regulation and are thus exempt from state gambling laws.

Tennessee regulators have taken the opposite position. They argue that when these event contracts involve sports outcomes they are economically equivalent to sports bets and therefore fall under state sports betting regulations rather than federal derivatives law. Under the Tennessee Sports Gaming Act any entity accepting wagers on sports must obtain state licensure comply with strict responsible gambling standards and meet other regulatory requirements that prediction markets do not currently satisfy.

This tension exposes a gap in the US regulatory framework. On the one hand federal law delegates authority to the CFTC to oversee futures and options contracts and protect market integrity. On the other states traditionally regulate games of chance including lotteries and sports betting imposing local standards for consumer protection tax collection and responsible gaming. When a financial technology intersects both domains regulators struggle to decide which regime controls.

Legal Fight in Federal Court

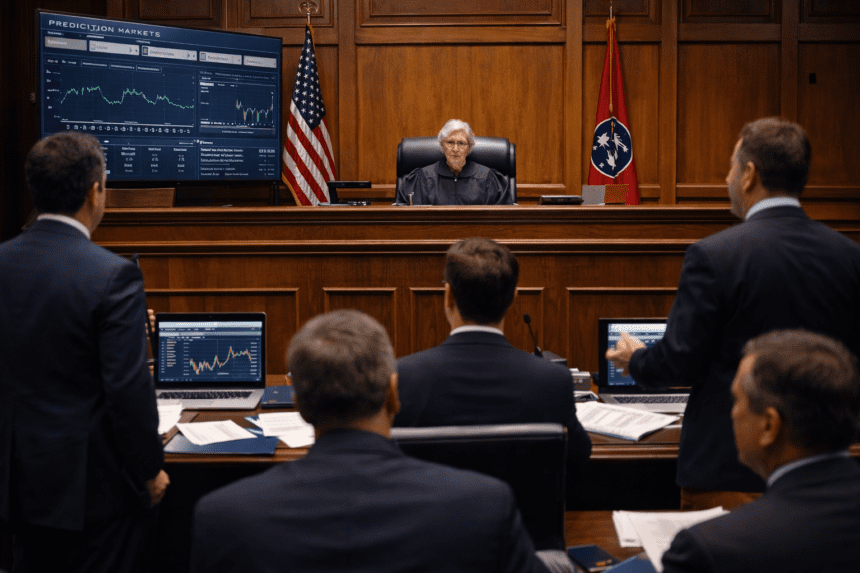

Almost immediately after receiving the cease-and-desist order Kalshi responded with a federal lawsuit seeking to block Tennessee’s actions. On January 12 2026 a US District Court judge Aleta Trauger granted Kalshi a temporary restraining order (TRO) preventing Tennessee regulators from enforcing their cease-and-desist while the legal battle continues. The judge cited Kalshi’s likelihood of success on the merits of its claim and the potential for irreparable harm if enforcement proceeded before the dispute over jurisdiction is resolved.

This restraining order allows Kalshi at least through late January to continue offering sports event contracts in Tennessee and defers the state’s refund deadline until after a preliminary injunction hearing scheduled for January 26. The federal judge’s intervention highlights how prediction markets have become major battlegrounds where differing interpretations of federal preemption and state authority collide.

Kalshi’s lawsuit similar to actions it has filed in other states argues that the state’s attempt to regulate its contracts intrudes on the federal government’s exclusive authority over derivatives trading. The company contends that Congress intended for designated contract markets to operate consistently across state lines under CFTC oversight. A ruling in Kalshi’s favor would strengthen federal preemption over state gambling laws in this context.

Consequences for Users and Markets

For customers in Tennessee and elsewhere the dispute creates uncertainty. If states are permitted to treat prediction market contracts as gambling they may block access regionalize markets and impose state-level compliance demands that fragment liquidity. Users who trade on events such as sports outcomes could find themselves geofenced out of certain markets forced to close positions or withdraw funds.

On the other hand a federal court decision affirming federal preemption could solidify the legality of prediction markets nationwide under the existing CFTC framework. That outcome may encourage platforms to expand offerings but could also prompt states to push back more aggressively or pursue new legislation to assert local control.

In either scenario the legal fight underscores how much prediction markets have grown in popularity and complexity. These markets allow users to speculate on the outcome of political events economic indicators sporting events and other real-world results. They represent an emerging intersection between decentralized finance online trading and traditional gambling a space where regulators are still trying to find firm rules.

A Patchwork Regulatory Landscape

Even before Tennessee’s action this issue had already played out in a number of other states. Nevada courts have classified event contracts tied to sports outcomes as gambling subject to state laws. Maryland and New Jersey have also taken regulatory action to limit or ban such offerings. These state by state battles create a patchwork of rules that platforms must navigate to operate nationally leaving investors and users unsure of where and how they can participate.

Legal scholars and industry advocates argue that a clearer federal framework is needed to provide consistency. One proposal is to create explicit statutory language distinguishing prediction markets under the CFTC from sports betting regulated by states. Another approach could involve cooperative agreements where companies adhere to certain consumer protection standards acceptable to both federal and state authorities. But these solutions require legislative action and broad consensus that has yet to emerge.

What Happens Next

As Kalshi’s case moves forward the industry will be watching closely. If the federal court eventually rules that Tennessee’s attempt to regulate these contracts is unconstitutional the decision could set a strong precedent for other states to back off enforcement. On the other hand if the court sides with Tennessee it could embolden more states to assert their own regulatory frameworks and compel platforms to adopt geofenced restrictions on certain types of contracts.

Either outcome will shape the way prediction markets grow in the coming years. If federal oversight prevails platforms may feel more confident launching broader event markets including those tied to sports outcomes. If state regulation becomes dominant prediction markets could be forced into separate categories with different rules and access depending on where users live.

What is clear is that the hybrid nature of prediction markets part financial instrument part wager will continue to draw attention from regulators legislators and courts alike. As technology evolves and markets innovate legal definitions lag behind economic realities and both sides will have to adapt quickly to bridge the gaps.