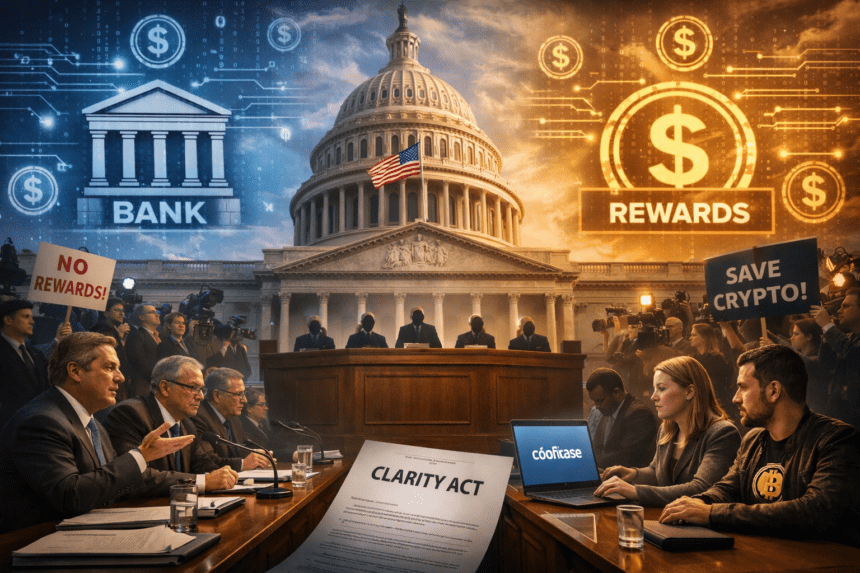

Coinbase, Banking Groups and Lawmakers Clash Over Stablecoin Rewards and the Future of Digital Money

In the rapidly evolving world of digital finance stablecoins have emerged as a cornerstone of crypto market activity. Designed to combine the benefits of digital currency with the stability of traditional money these tokens now constitute one of the largest segments of the cryptocurrency ecosystem. As their reach expands beyond niche investors into mainstream finance regulators are increasingly focusing on how these instruments are governed and how incentives tied to them should be treated under the law. In the United States a new legislative battle has begun that could determine not just the future of stablecoin rewards but also the terms under which digital assets operate across the financial system.

At the heart of this conflict is the CLARITY Act a comprehensive piece of legislation being considered by the Senate Banking Committee that aims to define the regulatory framework for digital assets including stablecoins. The act has gathered broad support from many corners of the industry and from some traditional financial institutions but a dispute over how stablecoin rewards should be treated is now threatening to unravel that coalition. The issue has pitted cryptocurrency exchanges and advocates against large banking groups and some lawmakers who see reward programs as a potential threat to financial stability.

Stablecoins are a form of cryptocurrency that seek to maintain a stable value typically by being backed one to one with a reliable asset like the U.S. dollar. They are widely used for trading lending payments and as a medium of exchange in decentralized finance and other blockchain driven services. Over time some stablecoin providers and platforms have begun offering rewards to holders usually in the form of interest or yield on the amount of stablecoin users hold in their accounts. These rewards have become a popular tool for attracting and retaining customers and have contributed to the rapid growth in the size of stablecoin markets.

Just last year the United States passed the GENIUS Act legislation which established a regulatory framework for payment stablecoins and included a provision that prohibited stablecoin issuers from paying interest or yield directly to holders. The rationale was that stablecoins should function as money rather than as investment substitutes for bank deposits and that offering yield could blur that distinction. However that law left open questions about whether third party platforms such as exchanges or wallets could offer their own reward programs funded through marketing budgets or other revenue streams.

The CLARITY Act is now tasked with defining the enforcement boundaries of that provision. The Senate markup session later this week will determine whether the law simply clarifies disclosure requirements or goes further by imposing limits or restrictions on how stablecoin rewards can be offered and by whom. The simplest outcome is a regime where rewards remain allowed so long as they are transparent and clearly disclosed. A more stringent outcome could effectively ban such rewards not just for issuers but for any intermediary involved in distributing stablecoins.

For many in the crypto industry this definitional battle is far more than a technicality. Exchanges argue that platform funded reward programs are part of legitimate consumer incentives akin to loyalty points offered by banks or credit cards. They contend that platforms funding rewards from their own resources is fundamentally different from issuers paying yield directly from reserve assets. The distinction may be subtle but insiders say it is crucial for determining how business models are structured and how users engage with stablecoins in practice.

Leading voices within the industry have signaled that this is a line worth defending. Most notably Coinbase one of the largest regulated cryptocurrency exchanges in the world has publicly indicated that it may withdraw support for the CLARITY Act if the law includes provisions that restrict stablecoin rewards beyond mere disclosure requirements. That stance underscores how deeply entwined reward programs have become with platform strategy and revenue. For companies like Coinbase these incentives are not just promotional tools but significant drivers of user engagement and revenue generation.

On the other side of the debate are major banking groups and associations who have urged lawmakers to interpret the legislation more broadly. They argue that any type of reward program that functions economically like interest or yield could disintermediate traditional banks and draw deposits away from the banking system. Banks contend that if stablecoins can offer attractive returns without being subject to the same regulations that govern banking deposits then the result could be an uneven playing field and increased risk for traditional financial institutions.

In a series of comment letters and lobbying efforts the American Bankers Association and a coalition of state bankers associations have pushed for the law to extend the prohibition beyond stablecoin issuers to affiliates and partners involved in routing rewards. Their goal is to close what they describe as the affiliate loophole that could otherwise undercut the intent of the original stablecoin restrictions.

The stakes of this conflict are high. Stablecoin markets already account for hundreds of billions of dollars in supply and trillions in transactional volume across global markets. According to industry forecasts the total supply of stablecoins may grow significantly over the next several years which in turn would expand the size of potential rewards pools. That scale explains why banks see these incentives as a structural threat and why exchanges see them as essential to competing with traditional financial offerings.

Supporters of preserving stablecoin rewards warn that limiting these incentives could slow innovation reduce competition and ultimately limit consumer choice. They argue that when used responsibly reward programs help attract users to new financial technologies and give consumers alternatives to legacy banking products that offer low returns on deposits in a low interest rate environment. Some also point out that stablecoin reward programs have not been shown to materially harm banking deposits and that the market has already adapted to regulatory restrictions on issuer paid yields without causing systemic disruptions.

The debate has also sparked wider discussions within the crypto community about the future of the coalition advocating for comprehensive digital asset legislation. Many industry participants had hoped that the CLARITY Act would mark a significant step toward regulatory clarity in the United States and establish a stable long term framework for digital assets. However if the bill falters over the rewards issue or if large players like Coinbase withdraw support it could signal deeper fragmentation within the industry’s political lobbying efforts.

Lawmakers now face the difficult task of balancing competing priorities. On one hand they must respond to concerns from the banking sector about financial stability and deposit flight. On the other hand they must consider the implications for innovation competitiveness and the political risk of alienating a fast growing segment of the financial sector. If the Senate language focuses strictly on disclosure and transparency it may preserve a middle ground allowing reward programs to continue under clear regulatory rules. If lawmakers instead adopt stricter restrictions the outcome could effectively gut reward programs and reshape the way stablecoins are marketed and used.

What happens next will reverberate across the broader cryptocurrency ecosystem. Exchanges could be forced to redesign their products. Consumers might see fewer incentives tied to stablecoin holdings. Traditional banks might breathe easier knowing fewer competing products offer high yields without similar regulatory oversight. Yet limiting these rewards could also slow adoption of stablecoins as everyday financial tools and shift the competitive balance back toward incumbent financial institutions.

The markup session scheduled later this week will be closely watched by market participants regulators and lawmakers alike. It represents a test of whether the broader coalition that has supported digital asset legislation can hold together when faced with specific definitional and economic disputes. Given the magnitude of the stablecoin market and the importance of clear regulation to broader financial innovation the outcome could influence U.S. policy on digital assets for years to come.

In the end the clash over stablecoin rewards is not just a technical debate about language in a bill it is a deeper reflection of the tensions between innovation freedom and financial system stability. How regulators choose to navigate this balance will send a powerful signal about the future trajectory of digital money and the rules that govern it. Regardless of the immediate outcome the debate marks a pivotal moment in the ongoing evolution of cryptocurrency regulation and the enduring effort to integrate decentralized technologies into the mainstream financial framework.