Why DeFi Exploits and Financial Design Flaws Are Now Far More Costly Than Traditional Hacks

In 2025, the number of announced cryptocurrency hacks where attackers steal funds directly from wallets, exchanges, or smart contracts fell by roughly 50 percent compared to prior years, a development that initially looked like a major victory for security teams and protocols worldwide. According to blockchain security data, fewer headline-grabbing breaches were reported, and total direct losses from classic hacks decreased sharply. However, a deeper look at the figures reveals a more insidious financial threat emerging in the crypto ecosystem one that isn’t measured in raw theft from breaches, but in poorly designed financial primitives, fragile tokenomics, and systemic vulnerabilities in DeFi protocols that led to far greater economic damage.

On the surface, crypto’s decreasing hack rate reflects improved technical defenses: teams invested in formal audits, bug bounty programs grew more robust, and security tooling became more advanced. Protocols that suffered repeated exploits in earlier cycles bolstered protections, and many projects prioritized secure design over rapid growth. This evolution is a positive trend, reflecting lessons learned from the explosive hack activity of previous years.

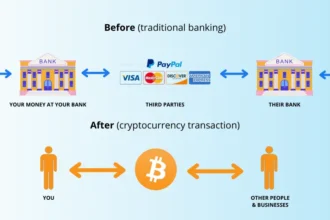

Yet the headline reduction in crude hacks masks a deeper shift in the risk landscape. While fewer attackers succeeded in forcibly withdrawing funds via exploits or vulnerability abuse, economic exploits where attackers manipulate financial mechanisms, oracle pricing, or protocol assumptions became far more costly. These types of abuses don’t always look like traditional hacks; instead, they involve market manipulation, unsound incentive structures, or flawed protocol logic that can drain liquidity and damage confidence without an obvious security breach.

One example that emerged in 2025 involved a decentralized finance (DeFi) protocol whose price oracle design made it vulnerable to economic manipulation. Instead of technical vulnerabilities in code that allowed unauthorized access, attackers exploited the way external price feeds were integrated, causing cascading liquidations, liquidity withdraws, and investor losses far exceeding typical hack sums. These events weren’t always classified as “hacks” in reporting because no unauthorized code execution occurred but the financial damage was enormous, dwarfing many direct-theft incidents.

Another dimension of this new threat involves fragile tokenomics and incentive models that promote instability. Some protocols structured reward systems that looked sustainable under ideal conditions but amplified risk under stress, encouraging speculative flows that eventually reversed violently. In these cases, no one “broke in” instead, the system broke itself, with users losing value as incentives unwound or collapsed.

These economic exploits and design failures show why counting hacks alone underestimates the total financial risk in crypto systems. Classic security breaches stolen private keys, exploited code, unauthorized drains — remain serious, but they are increasingly overshadowed by protocol design failures that cost far more and are less visible until they unfold. The dwindling volume of traditional hacks might therefore reflect improved security tooling, but the rising cost of financial exploits suggests that the threat model has evolved.

Market participants, auditors, and risk analysts are paying close attention to this shift. Whereas earlier years focused heavily on patching vulnerabilities and securing wallets and smart contracts, 2025 revealed that sound financial architecture and economic incentive alignment are now central to crypto safety. Projects with well-tested tokenomics, resilient liquidity models, and robust governance frameworks withstood market stress more effectively, while those with weaker economic designs suffered disproportionately.

This evolution in risk has broader implications for how the industry assesses project health and stability. Traditional hack metrics number of breaches, total stolen value, frequency of exploits are easier to quantify but increasingly insufficient as a holistic measure of systemic risk. Economic exploit losses, governance failures, and fragile incentive structures are harder to aggregate and report, yet they represent the emerging terrain where “slow failures” and complex market interactions inflict far greater damage.

Experts now emphasize the importance of economic audits and incentive-model reviews alongside traditional security audits. An economic audit examines how token supply dynamics, reward schedules, oracle dependencies, and liquidity flows behave under a range of stress conditions aiming to ensure that no combination of normal market behavior and protocol mechanics can lead to catastrophic loss. Whereas security audits focus on code vulnerabilities, economic audits consider design vulnerabilities.

The shift also highlights the importance of transparent governance and community oversight. Protocols that allow stakeholders to respond to emerging risks collectively, adjust parameters in a timely manner, and engage in decentralized decision-making tended to mitigate economic stress better than those with opaque or centralized governance structures. The presence of clear risk frameworks and responsive governance can act as a buffer against systemic failures that aren’t driven by external attackers.

For investors and participants, the 2025 data serves as a wake-up call: security in crypto isn’t just about preventing malicious outsiders from breaking in it’s about ensuring that protocols don’t break down from within. This more nuanced understanding of risk demands broader analytical tools, interdisciplinary audit practices, and a focus on alignment between technical security, economic design, and governance resilience.

In essence, the drop in hack frequency in 2025 was good news but only part of the story. The rise of economic exploits and systemic design failures reveals that the crypto risk landscape is evolving, and the greatest threats may no longer be from outsiders exploiting code, but from structural weaknesses in the very systems meant to power decentralized finance and digital value exchange.