From Speculation to Substance, the Market Is Rewarding What Lasts

An opinion piece: The recent shift in crypto markets does not signal the end of opportunity for smaller-cap assets. Instead, it marks the beginning of a more powerful, selective phase of growth one where strong communities, real value, and demonstrated utility matter more than hype cycles or short-term price action. Meme coins and small-cap projects are no longer being judged solely by how loud they are, but by how meaningful and resilient they can become.

For years, crypto rewarded speed over substance. A catchy narrative, a viral meme, or a trending hashtag could be enough to ignite massive rallies. That era is fading. Today’s market is filtering aggressively, and what survives this filter are projects built on conviction, execution, and relevance. This is not a loss for crypto it is a maturation.

Community Is No Longer a Marketing Tool It’s the Foundation

In the current environment, community is no longer something that forms after a token pumps. Community is the core infrastructure. Strong communities don’t just speculate; they contribute, test, govern, promote, and defend the project they believe in. They give projects staying power when markets turn quiet and momentum when conditions improve.

The most resilient crypto projects today are those where the community feels like a shared mission rather than an audience. These communities show up consistently during downturns, during development delays, and during moments when price action offers no immediate reward. That persistence is not accidental; it is built through transparency, trust, and meaningful participation.

A strong community turns users into advocates and holders into builders. It creates feedback loops that improve products, sharpen narratives, and keep projects relevant long after speculation fades.

Utility Turns Narrative Into a Growth Engine

Narrative still matters but narrative without utility no longer survives. In this new phase, the projects that thrive are those that connect story with function. When narrative is paired with actual use cases, cultural relevance, and active participation, it becomes a powerful growth engine rather than a hollow promise.

Utility does not need to be complex or over-engineered. It needs to be clear, used, and valuable. Whether it’s access, rewards, governance, identity, entertainment, or social coordination, utility gives a reason for a token to exist beyond price speculation. It answers the question every market eventually asks: Why does this need to exist?

Projects that prioritize building utility first and allow the community to amplify it organically are proving they can survive extended bear conditions and outperform when liquidity returns. The easy speculation era may be over, but what is emerging in its place is far more durable.

A Reset, Not a Rejection

The steep fall in small-cap valuations has not killed altseason it has reset the playing field. Weak ideas, empty promises, and copy-paste tokens have been flushed out. What remains is space space for builders, creators, and communities willing to do the work.

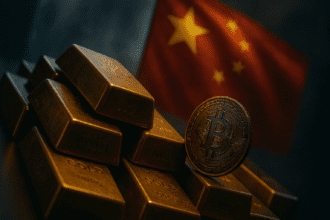

With capital concentrating in Bitcoin, Ethereum, and high-utility ecosystems, liquidity is not abandoning the market it is laying foundations. This consolidation phase is creating clearer standards. When risk appetite expands again, capital will not flow blindly. It will seek projects that already demonstrate traction, usefulness, and loyal communities.

This is where smaller-cap projects with real engagement gain an edge. They are building quietly, strengthening culture, shipping features, and refining their identity while others wait for momentum to return.

Earned Momentum Is the New Altseason

The future of crypto is no longer about indiscriminate rallies where everything moves together. It is about earned momentum. Meme coins that evolve into brands, utilities, or social layers of Web3 are especially well positioned. They sit at the intersection of culture and technology a place crypto has always thrived when done correctly.

As institutional adoption grows and infrastructure matures, the market will increasingly reward projects that combine:

Clear purpose

Real usage

Cultural relevance

Strong, engaged communities

These are not short-term traits. They are long-term advantages.

Altseason Isn’t Dead It’s Upgrading

Altseason is not disappearing; it is transforming. The next wave will not lift everything equally. It will reward builders over promoters, communities over crowds, and value over volume.

Projects that focus now on community trust, real utility, and sustainable value creation — are positioning themselves to define the next cycle of outsized returns. While others fade, these projects are compounding something far more important than price: belief, usefulness, and resilience.

In this upgraded market, community is currency, utility is proof, and value is earned not promised.