Mt Gox FUD vs Bitcoin ETFs: The Real Selling Pressure

Setting The Scene: Another Mt Gox Panic While Bitcoin Bleeds

Every time a Mt Gox wallet twitches, Crypto Twitter goes into full meltdown mode. This time was no different. Around Nov. 17, roughly 10,600 BTC linked to the defunct Mt. Gox exchange moved after months of silence, just as Bitcoin was already sliding below the psychologically huge $90,000 mark.

Headlines screamed “Mt Gox is dumping,” feeds filled with bearish memes, and traders rushed to blame the old ghost of 2014 for the latest red candles. But when we zoom out, a very different picture emerges: spot Bitcoin ETFs have already sold more BTC into the market than Mt Gox even has left to distribute.

So in this article, we are going to strip away the noise, walk through what actually happened with Mt Gox, compare it to the brutal ETF outflows, and show why the real story is about modern market structure, not a decade-old bankruptcy.

What Actually Happened With The Latest Mt Gox Wallet Move?

On-chain trackers noticed that Mt Gox controlled wallets shifted a bit over 10,600 BTC to a fresh, unlabeled address, while sending the leftover back to a known Mt Gox wallet.

No coins hit exchange deposit clusters. No large inflows suddenly showed up at Kraken, Bitstamp, or other venues that historically handled creditor distributions. The court-appointed trustee did not announce a new payout wave. From a purely blockchain-forensics point of view, this looked like an internal reshuffle rather than a sell-off.

Yet, the timing was terrible. Bitcoin had already cracked below $90,000, ETF outflows were ramping up, and traders were desperate for a villain. The wallet move arrived like a spark in a dry forest perfect fuel for another round of Mt Gox doom posts.

Quick Refresher: What Is Mt Gox And Why Does It Still Matter?

Mt Gox, short for “Magic: The Gathering Online eXchange,” was once the place to trade Bitcoin in the early 2010s. It handled the majority of BTC spot volume at its peak. Then came the hacks, the insolvency, the missing coins, and eventually a long, grinding rehabilitation process under Japanese law.

Over the years, investigators and the trustee pieced together a pool of recoverable assets: roughly 142,000 BTC, a similar amount of BCH, and tens of billions of yen in cash.

This stash became the market’s favorite boogeyman. Every cycle, traders worry: “What happens when 100k+ BTC finally hits the market?” Even as distributions have slowly trickled out, the narrative persists that one giant “Mt Gox dump” could nuke the price.

The reality today is very different from that old nightmare.

How Much Bitcoin Does Mt Gox Still Hold Today?

According to on-chain tracking of wallets attributed to the Mt Gox estate, there is now a much smaller stack left compared to the original arsenal. After a series of distributions through 2024 and 2025, the remaining BTC balance sits around 34,700 BTC—roughly one quarter of the original 142,000 BTC pool.

At current prices in the high-$80k to low-$90k range, that’s still around $3 billion worth of Bitcoin serious money, but not the existential tidal wave people imagined years ago.

In other words:The “monster” everybody feared is already three quarters gone.

What remains is large but finite, and it’s being handled on a slow, legalistic timetable rather than a single trigger event.

Yet every time those wallets move, markets react as if we are still staring at the full 142k BTC cliff.

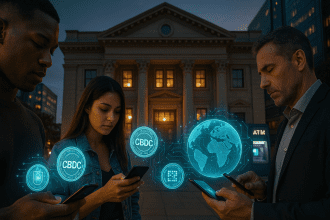

The ETF Elephant In The Room: Flows Dwarf Mt Gox Overhang

Now let’s talk about the real whale in the room: spot Bitcoin ETFs.

Over November alone, US-listed Bitcoin ETFs have seen multi-billion-dollar net outflows as investors redeemed shares in size. Some trading days recorded over $2.5 billion leaving the ETF complex in a single session, with cumulative outflows pushing past roughly $3–4 billion in just weeks.

Those redemptions translate directly into BTC being sold or removed from ETF holdings—today, not years from now. The ETF complex is effectively a firehose of supply when sentiment flips.

When we compare scale:

Mt Gox has about 34k–35k BTC left.

ETF outflows over a short stretch can represent more Bitcoin changing hands than that entire remaining pile, once we map the dollar values at current prices.

So while social media fixates on a single internal Mt Gox transfer, spot ETFs have already pushed more BTC through the market than Mt Gox can still distribute in total. That’s the real headline.

Why Markets Overreact To Every Mt Gox Headline

If ETFs are the bigger driver, why does Mt Gox still cause such chaos?

Part of it is trauma. Old-school Bitcoiners lived through the original collapse. Mt Gox is wired into the community’s nervous system as the symbol of catastrophic risk. Newer traders absorb that fear second-hand through memes, charts, and recycled horror stories.

Another part is narrative laziness. When price dumps, people want a simple explanation. “Mt Gox is dumping” fits in a tweet. “Complex interplay of ETF flows, macro risk, and positioning unwinds” doesn’t slap nearly as hard.

Finally, volatility itself amplifies the story. In a falling market, traders are hyper-sensitive to anything that might add supply. An on-chain transfer looks like “proof,” even when it never touches an exchange.

Internal Wallet Moves vs Real Sell Pressure

We need to draw a hard line between two very different things:

Coins moving between addresses under the same trustee’s control.

Coins being credited to end creditors or sent to exchanges where they can actually be sold.

In the latest case, the BTC moved from one trustee-linked address to another fresh, unlabeled one, with the leftovers returning to a known Mt Gox wallet. No major exchange clusters lit up, and there were no matching inflows that screamed, “These coins are about to hit the order books.”

Historically, we have seen similar internal reorganizations before earlier rounds of payouts. They’re like a bank moving funds between internal ledgers before sending wires—operational prep, not public selling.

Until we see:

deposits landing in exchange-controlled wallets, or

explicit trustee notices about new distribution waves,

internal wallet movements should be viewed as housekeeping, not sell triggers.

The Repayment Timeline: Why 2026 Matters More Than This Week

In late October, the Mt Gox trustee extended the final repayment deadline to Oct. 31, 2026. At the same time, they confirmed that the main phases of repayments—base, early lump-sum, and intermediate—had been wrapped up for creditors who completed all requirements.

What does that tell us?

It suggests that:

The process is far along, not just starting.

Remaining distributions will be spread out over years, not dumped all at once.

Administrative progress, paperwork, and compliance gates matter more than Bitcoin’s weekly price swings.

So the idea that a random November wallet shuffle somehow signals immediate liquidation is at odds with the official schedule. The estate is playing a long, highly regulated game, not day trading the chart.

ETF Outflows, Not Mt Gox, Drove Bitcoin’s Drop Below $90k

Let’s connect the dots.

Before the Mt Gox wallets even moved, Bitcoin was already sliding under $90,000. Spot ETFs were bleeding assets, with billions of dollars flowing out as investors derisked into year-end.

At the same time, broader macro conditions were turning risk-off. Concerns around global growth, rate expectations, and equity volatility nudged big allocators to trim high-beta exposure including Bitcoin.

In that environment, ETF outflows matter far more than a single 10,600 BTC transfer that never touched an exchange. The wallets simply provided an easy scapegoat. Traders grabbed the Mt Gox story and pasted it onto a selloff that was already in motion.

The cause wasn’t ancient coins. It was modern market plumbing.

On-Chain Clues: What The Data Really Shows

On-chain analytics back up this story.

When Bitcoin is under genuine distribution from old wallets, we tend to see:

Rising exchange inflows from long-dormant coins.

Spikes in “coin days destroyed” and similar metrics.

Clear clusters of deposits into known trading venues.

In this Mt Gox episode, we mainly saw coins go from one trustee-linked address to another, followed by silence. That’s consistent with internal reorgs, not with heavy selling.

Separate analyses of ETF holdings and flows tell a different tale: several large ETFs, including some of the biggest products on the market, have reported sizeable reductions in their BTC positions over recent weeks, in line with those multi-billion-dollar outflows.

In other words, on-chain and off-chain data both point to ETFs as the main source of selling pressure.

What This Means For Short-Term Traders

If we trade short-term, we live and die by liquidity and narrative. Mt Gox headlines will keep popping up, but we do ourselves a favor by ranking them properly against other forces:

ETF flows are a real-time barometer of institutional sentiment.

Macro news and interest-rate expectations can move more Bitcoin in a week than old rehab coins could in months.

Sudden exchange inflows from any whale cohort—miners, treasuries, funds—often matter more than which legacy wallet they came from.

So in the next panic, instead of reflexively blaming Mt Gox, it’s smarter to ask:

What are ETFs doing today net buying or net redeeming?

Are we seeing actual exchange inflows, or just blockchain reshufflings?

Is this move lining up with macro risk-off flows across equities and bonds?

Trading without that context is like flying through a storm staring only at one blinking light on the dashboard.

What This Means For Long-Term Bitcoin Holders

For long-term holders, the Mt Gox narrative can feel like a recurring nightmare that never quite ends. But from a structural perspective, this latest episode is actually reassuring.

Here’s why:

Most of the original Mt Gox BTC stash has already been distributed.

The remaining balance is a fraction of daily global Bitcoin volume and ETF capacity.

Distributions are happening over years, under a legal framework that does not reward panic dumping.

Meanwhile, the ETF ecosystem has introduced a new dynamic: regulated pipes that can channel massive capital flows in both directions. That can amplify volatility, but it also anchors Bitcoin deeper into traditional finance.

From a multi-year perspective, the key question is not “Will Mt Gox dump tomorrow?” but “Will Bitcoin continue to win the macro adoption battle despite cyclical ETF outflows?”

Is The Mt Gox Story Already Mostly Priced In?

We should be honest: Mt Gox has been hanging over the market for so long that it is hard to argue it is some shocking unknown risk. Every cycle, traders discuss it, models include it, and news outlets track every trustee update.

When risk is:widely known,repeatedly discussed, and gradually resolved over years, its ability to truly surprise the market shrinks.

What does surprise markets are things like:faster-than-expected rate changes, sudden regulatory decisions, or

unanticipated ETF behavior (like record outflows or inflows).

In that sense, the Mt Gox overhang is now more like background noise. Important, yes, but not the knife hanging over the chart that people imagine from old Reddit threads.

How To Read Future Mt Gox Headlines Without Panicking

Mt Gox isn’t going away overnight. We will keep seeing wallet moves, trustee notices, and creditor updates all the way through the extended 2026 deadline.

Instead of reacting emotionally, we can adopt a simple mental checklist whenever the next “Mt Gox is dumping” headline hits:

Did coins actually arrive at an exchange or a known custodian that distributes to end users?

Did the trustee announce a fresh distribution phase, or is this just internal shuffling?

How big is the movement compared to daily trading volume and recent ETF flows?

Are ETFs net buyers or net sellers this week?

Once we answer those questions, we often realize the real driver is somewhere else—and that the Mt Gox label is just being slapped onto existing fear.

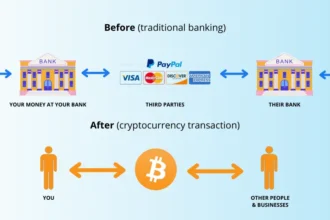

Risk Management In A Post-ETF Bitcoin Market

We are no longer in the 2017 “Mt Gox vs retail” world. Bitcoin now trades in a market shaped by:

regulated ETFs,

institutional desks,

macro hedge funds, and

global derivatives markets.

In that environment, risk management means:

focusing on liquidity drivers like ETF flows and futures positioning,

understanding how macro data releases impact risk assets, and

sizing positions so that any surprise whether Mt Gox, regulation, or macro doesn’t blow up the account.

Old ghosts like Mt Gox make great headlines, but new market structures decide where price actually settles.

Final Thoughts: Housekeeping, Not A Starting Gun

When we put all the pieces together, the narrative flips:

The recent Mt Gox wallet movement looks like internal housekeeping by the trustee, not an imminent tsunami of selling.

The estate’s remaining BTC around 34k-plus coins is large but finite, and already overshadowed by the scale of spot ETF flows.

The real pressure on Bitcoin around the $90k breakdown came from ETF redemptions, macro risk-off flows, and position unwinds not from a decade old exchange’s bookkeeping.

Mt Gox still matters, but mostly as a slowly unwinding legal process. Spot ETFs, on the other hand, are a living, breathing force that can add or remove tens of thousands of BTC from effective float in a matter of days.

If we want to navigate the next phase of this market, we need to treat Mt Gox as what it is today: a manageable overhang being resolved over years—while keeping our eyes firmly on the ETF firehose that actually moves the needle in real time.

1. Is Mt Gox about to dump all its remaining Bitcoin on the market?

No, that scenario is extremely unlikely. The trustee is operating under a formal rehabilitation plan with a deadline extended to late 2026, and distributions are being handled in structured phases, not in one giant market-crashing sale. Most of the original stash has already been repaid, and the remaining coins are being managed along a long, legalistic timetable instead of sudden discretionary dumps.

2. Why did Bitcoin fall below $90,000 if Mt Gox hasn’t sold yet?

Bitcoin’s break below $90,000 lined up with heavy outflows from spot ETFs and broader risk-off behavior in macro markets. Funds were redeeming ETF shares in size, effectively shrinking ETF BTC holdings and adding selling pressure, while investors de-risked ahead of year-end. The Mt Gox wallet move happened into that backdrop and became a convenient scapegoat—but the selling pressure was already there.

3. How big are ETF outflows compared to Mt Gox’s remaining Bitcoin?

ETF outflows over just a few weeks have already amounted to billions of dollars in redeemed Bitcoin exposure more than the entire remaining Mt Gox BTC stack once you translate the dollar values to coin counts at current prices. Mt Gox still holds tens of thousands of BTC, but ETF flows can eclipse that impact in a very short window.

4. How can I tell if a Mt Gox wallet move actually matters for price?

The key is to see where the coins go. If they move between trustee-controlled addresses with no evidence of deposits into exchange wallets or distribution partners, it usually signals internal reorganization rather than active selling. When coins land in exchange clusters or a new distribution phase is announced, then the potential for real sell pressure increases but even then, the impact depends on the pace and behavior of individual creditors.

5. As a long-term holder, should I worry about Mt Gox anymore?

It’s sensible to stay aware of Mt Gox developments, but constant panic is not warranted. The majority of the legacy stash has already been released without triggering apocalyptic crashes, and the remainder is modest relative to global liquidity and ETF capacity. For long-term holders, the bigger questions center on adoption, regulation, macro trends, and institutional demand—all of which dwarf the residual Mt Gox overhang over a multi-year horizon.