Key Highlights

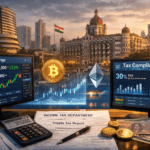

• Bitcoin fell 14% this month, trading at $95,521.

• Spot Bitcoin ETFs posted outflows of $866 million over a 24-hour period.

• A drop below $95K might send BTC down to the $86K-$80K range.

• A recovery above $98K may reignite bullish momentum.

Overview of the market

Bitcoin struggles to stay above the bearish pressures following a slip into the $95,000 zone, stirring fears of a deeper market correction. While the cryptocurrency surged to $126,000 in October, it has been persistently pulled back by profit-taking 14% lower in the last month.

Currently, BTC changes hands at approximately $95,524, just below the important $100K psychological mark.

What’s Driving the Decline?

Recent Selling Activity has increased sharply:

• Trading volume soared 69% to $129 billion, which could be a sign of heavy selling.

• A record $866 million flowed out of spot Bitcoin ETFs in one single day.

• Grayscale alone had $318 million in withdrawals, according to Farside Investors.

Critical Price Zones to Watch

The key support lies at the $95K mark. A break here could open the door for a slide toward the $86K-$80K region.

Technical point of view:

• BTC lost support at $98K and turned the trend bearish.

• The present $95K area might still be able to contribute as a reversal.

• RSI is presently at 54, where the moving average stands at 41, showing that the sellers have momentum.

Analysts are watching closely to see if BTC can reclaim $98K – a level that might set up a push higher toward $105K.

What Analysts Are Saying

Some analysts believe that long-term investors are holding firm, and large buyers may be quietly accumulating. Others are more cautious, warning the market could test lower levels before any strong recovery. Over $1.4 million has been wagered on the prediction platform Polymarket that BTC will drop below $90K by the end of the year. Crypto analyst Ted also pointed out a CME gap at around $92K-$93K, which he said BTC may visit before bouncing back.

Conclusion

The recent slump to $95K has divided opinion on whether Bitcoin is correcting or building up steam for another move higher. If it holds above this level, bulls may regain control, but if it breaks, the next stop could be closer to $80K. The next few days will be key.