Ripple’s $40B empire beat the SEC yet still ghosts Wall Street IPO

Ripple has had one of the most surreal rides in the last few years. Even though it has spent years at odds with the U.S. Securities and Exchange Commission, Ripple won the battle, and a federal judge ruled that XRP, because it is traded on public exchanges, is not inherently a security; Ripple was in a unique legal position. That victory lifted an enormous regulatory cloud hanging over the company and its token and it provided Ripple with momentum that many figured would push it toward becoming a publicly traded juggernaut. The company has secured hundreds of millions in private capital and is currently valued near $40 billion a figure that usually indicates an IPO is in process.

Instead, Ripple surprised and excised investors by claiming that it has no plan for going public. The company is still quietly choosing to remain private, and while Wall Street expressed interest, it’s not saying so. This decision makes sense because most businesses with Ripple’s price and name recognition would be running to a stock listing.

This is one expectation of investment: Liquidity, exposure to markets and the added attention that comes with being able to ring the bell on the New York Stock Exchange. Ripple’s leadership, however, have underscored that the company does not need to enter any public markets for its growth to happen. They maintain, however, that, given adequate private capital and stable business evolution, there simply is no viable incentive to carry the kinds of burdens that come with being a public company. Ripple has that level of capital; enough revenue stability; enough partnerships globally so that it can function comfortably without going to Wall Street for cash. Ripple’s calculus another big part of its decision-making is also the harsh reality of how public markets treat crypto-related companies.

When Coinbase went public in 2021, the moment had enormous hype, with heavy market activity and a price plunge during peak periods. Robinhood faced the same turbulence after its IPO even though a big name in the retail trading boom. These cases demonstrate, there is nothing to show for the idea that in any case that even companies with huge user bases and brand value, once they go public are immune to that kind of stability when they enter the public space, then to maintain a stable valuation.

Ripple’s business is even less insulated from the crypto market than these players’, and public investors would continuously examine Ripple’s financial stability according to whether XRP price swings fluctuate, its trading volumes rise and fall and the overall market mood. Ripple also has quite a bit of XRP in escrow, and even that would attract huge amount of media attention if the company was announced publicly. Investors would call for comprehensive reports on how much XRP Ripple releases, how frequently it sells and how those sales affect the market. Ripple’s token holders are already watching Ripple closely and it risks an extra layer of pressure from shareholders pressuring the company to be public, who could want it to monetize its XRP holdings more aggressively. That could lead to a schism between equity investors and token holders, who are often not on equal footing on what is most important. Not allowing the rest of Ripple’s XRP holdings to remain private protects Ripple from becoming a headline item or even a quarterly buzzword. Another cause for fear is the U.S. regulatory environment.

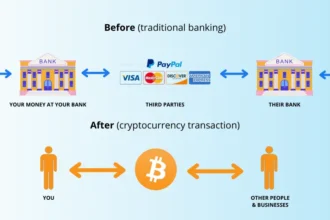

Ripple’s decision in the case isn’t enough, however; although Ripple secured an important judgment in court in order to win major favor to Ripple, wider crypto regulation overall, laws around the crypto sector are still muddled and varied. Disputes along jurisdictional lines among federal government entities continue, and where enforcement is concerned remains difficult to assess. Raising concerns, if they were not resolved to be public, could put Ripple face to face with even stricter regulatory frameworks, disclosures, and continuing monitoring. Instead of risking mistakes or misunderstanding, Ripple seems to be waiting for clearer, more uniform laws before deciding if it would consider what should be an IPO. The company is global, and lots of its strongest partnerships also have their sources outside the U.S., so there isn’t a great incentive to list on an American exchange. It is also good for Ripple as institutions are increasingly interested in XRP per se. A spot XRP ETF has been opened, enabling investors not only to avoid Ripple shares but to gain exposure to the asset with the implementation of a regulated product. And it enables institutions to enter XRP’s ecosystem but Ripple, on the other hand, is still a private company. In a way, Wall Street is at least having access to XRP no matter what Ripple’s IPO plans are.

This diminishes the need for the company to go public just to appease institutional appetite. The company’s decision to remain private implies one based around patience and positioning for the long haul. Ripple is concentrating on scaling and expanding its payment-system offering, fostering partnerships with banks and financial institutions and increasing its global deployment of cross-border XRP. It does take time for these developments to develop, and they don’t always bring the fast quarterly trends that public investors demand. Ripple is thus able to keep growing without the fear that the stock price might fall, or that the analysts would respond negatively. It can innovate at its own speed, quietly pursue partnerships and adapt to evolving regulations, without having to justify every move to shareholders. Ripple’s position reflects a broader trend in the crypto industry.

Crypto companies have also been seeking confirmation through public listings, partnerships with traditional financial institutions and acceptance in the mainstream for years. Now Ripple’s unwillingness to sign up for an IPO points to reversal. Instead of crypto needing Wall Street, Wall Street increasingly seems to want crypto. As tokenized finance, digital settlement systems and blockchain infrastructure gain ground, meanwhile, traditional markets are trying to connect with technology companies like Ripple have been experimenting with for years. The most important lesson here is that Ripple’s decision isn’t a sign of weakness.

It reflects confidence. Ripple seems far from requiring the cash, the publicity or the seal of approval with a public listing. It is opting for control, stability, and independence in preference to the volatility and pressures of public markets. The company may go public down the line, but when, it will do so on its own terms, in an environment that fully understands how to value a crypto-native company. In fact, staying private is not a retreat it’s a disciplined method meant to safeguard Ripple’s future and ensure that XRP grows in a direction untethered to the dictates of quarterly earnings. And if anything, Ripple’s story is evidence that winning against the SEC was just the beginning.

The company is choosing the route that gives it the highest degree of leeway in determining the future of global payments, no matter how much it costs to get there, even if only after “ghosting” Wall Street for a little while.