XRP Price on Edge: Watch These 4 Tripwires for Breakout This Week

If you’re waiting for XRP to move, the week ahead could prove pivotal but only if four crucial market “tripwires” are crossed in the coming days. These readings operate like indicators, and when they line up, big price action often follows. Today, the XRP markets are in a precarious place and minor fluctuations in funding, open interest, volatility or the strength of the dollar index might spark the next move higher or crush it.

A Market of Money That Stays “Positive” for Days, Funding rates reflect how much traders pay to hold long or short positions in perpetual futures. When funding is positive that longs pay shorts it reflects traders’ expectations of rising prices. And the key isn’t just one positive test but days of a sustained positive funding rate at least 48 hours. When it does, it can indicate that the bulls have control for long enough to press short sellers and produce a breakout. Look out for: Financing over 0.02% for a number of periods.

Why it matters, More: Why we keep them longs confident. Warning: If funding shoots too high too quickly, that might be a sign of overconfidence the kind that leads to reversals.

Open Interest on Its Way to $5 Billion Open Interest (OI) is the amount of money that is tied up in active futures contracts. Higher OI indicates more bets are being made which then adds “fuel” to some price move. When XRP’s aggregate open interest approaches $5 billion, historically it has caused the market to have significant leverage to facilitate a bigger and faster move. Given positive funding, it can induce short squeezes and explosive rallies, that grows slowly and methodically with the accompanying strength in prices.

Bullish bias, increase, positive funding and price up. Bearish indication: OI increasing on declines (short accumulation).

Macro Volatility Watch the VIX, The VIX index measures anticipated volatility in U.S. stocks and serves as an indirect gauge of global risk attitudes. The $VIX chart currently reads 35 as I write this, the calmness of anything under 20 typically supports risk assets like #Ripple get above 22 and the momentum dies. Friendly zone: 14–18 VIX, investors at ease a good time for crypto to trend higher.

Danger zone: VIX above 22 suggests fear and likely pressure in risk markets. In brief: when Wall Street sneezes, crypto tends to get the flu.

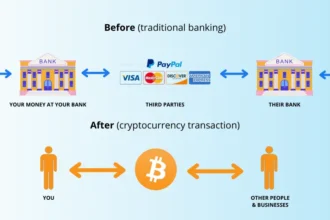

The U.S. Dollar Index (DXY) The dollar remains king of global liquidity. A rising dollar (DXY > 100) is supportive of financial tightening and a headwind for crypto. Alternatively, a weaker dollar (<100) typically boosts assets such as Bitcoin and XRP. It’s this simple threshold that bears watching. If DXY remains below 100 and the other three indicators remain green, XRP’s setup may be robust. If it gets above 100, batten down the hatches. How Everything Adds Up: XRP Beta to Bitcoin For XRP, who generally follows what Bitcoin does but takes it a step further (read: amplifies), that’s the price action of digital assets right now”. In established markets & good leverage, it performs usually 1.5 -2 x time better in % than btc (farmed on photo). But there is a double-edged sword to that: a brutal Bitcoin correction could drag XRP down twice as hard. At present, the general crypto market is cleaner after its recent leveraged cleanse which, for XRP, provides a better opportunity to follow BTC’s next trend move should those tripwires sync.

.Additionally, CME debuted its XRP futures which enabled institutions to hedge and trade in a more efficient manner. These upgrades increase liquidity and credibility, providing space for XRP to surge higher when the time is right. Add to that $5B+ of new crypto investment inflows just last month, and it’s a platform for renewed market confidence. Conclusion This week’s look at XRP is all about looking for those four tripwires: funding, open interest, volatility and dollar. If those four things are in sequence continued strong funding, OI around $5B, VIX back under 20 and DXY lower than 100 XRP could finally see the necessary break away momentum for that breakout. But if any of these rebel, be prepared for fakeouts and false starts. In crypto, timing is not luck it’s resonance. Observe the signals, be patient and let the data do the talking. FAQs Is positive funding always bullish? That is, unless it happens for more than several intervals spikes typically don’t linger long. Why does $5B open interest matter? That will be a key level that demonstrates heavy participation in the market, which is fuel for breakouts. What if the VIX soars to over 22? That’s a risk-off signal. Crypto typically falls when investors flee to safety. Why does a strong dollar impact XRP? A strong dollar is liquidity draining; a weak one helps risk assets rise. Could XRP outperform Bitcoin? Yes: In bull setups, XRP’s beta may double the gains of BTC.